For those who are fond of the automotive world’s technology, it is significant the outstanding electric direction of the models presented downtown in Milan on the occasion of Milan Monza Open-Air Motor Show held last weekend, from 10th to 13th June.

The vehicles that underline the boost of the new electrification era include CUPRA Born, presented to the public just on the occasion of the event.

It is the first 100% electric model of the brand, able to guarantee up to 540 km of autonomy, with advanced technological equipment and extremely appealing design.

The 1.4 e-HYBRID 245 CV DSG motor has maximum autonomy of 55 km in purely electric modality and it allows reducing emissions to just 31-35 g/km.

You can choose among 150 HP (110 kW) and 204 HP (150 kW) electric motors that supply energy to rear wheels. If combined with a high-performance lithium-ion battery with a capacity up to 58 kWh, propulsors assure a high autonomy of about 420 km. Moreover, in the e-Boost1 version, CUPRA Born provides even higher performances: the maximum power reaches 231 HP (170 kW), whereas the battery with maximum capacity of 77 kW grants an approximate 540-km autonomy.

Worth highlighting recharge process and times: it is sufficient to connect the model with a 125-kW net for just 7 minutes to reach a sufficient charge to travel for 100 km.

Designed and developed in Barcelona, in Martorell headquarters, CUPRA Born will be produced in Zwickau factory (Germany), and it will be available starting from Autumn 2021.

Milan Motor Show: the electric way was “born”

Marelli, a stronger and stronger presence in China

In the ambit of the new integrated footprint, Marelli has a significant presence in China, with 22 manufacturing sites and 8 Research and Development centres in 15 cities.

With over 6,000 workers, who represent 10% of Marelli manpower, and with a rising portfolio of customers due to the organic growth of the company and of its nine joint ventures in this Country, China constitutes for Marelli the most important market for the future development.

A key element that mirrors China’ priorities is Marelli’s share in the carbon neutrality through its technologies.

In this vision, the first element concerns electrification, key element of Marelli’s technological strategy, with combined competences concerning electric motors and thermal systems.

Concerning this, Marelli’s strategy is based on an integrated offer of complete solutions able to control and to optimize efficiently the whole energy flow in electric vehicles.

Among top products of the Business Unit Electric Powertrain there is e-Axle, which integrates inverter, electric motor and gearbox in a single key component.

Speaking of Marelli, anyway, it is worth mentioning its recent R&D novelty: a power electronics module dedicated to applications of electric and hybrid traction in motorsport ambit fully made with silicon carbide technology (SiC) and with a new direct cooling solution.

This forefront system will constitute the base element for even more efficient, compact and lighter inverters.

Boom of electric motors: the demand for minerals is rising

The last report “The role of critical minerals in clean energy transitions”, published by the International Energy Agency (IEA) has highlighted that the necessary energy transition will imply a further stress on material flows for many minerals.

Flows that never stop: the global mining of raw materials has increased by 3.4 times since 1970, rising from 27 to 92 billion tons yearly, with the addition of just 8.6 coming from recycling.

«Data – Fatih Birol, executive director of IEA, explained – show an incumbent gap between the world’s strengthened climatic ambitions and the availability of critical minerals that are essential to implement such ambitions. Challenges are not insurmountable but Governments must give clear indications about how they are transforming their commitments to climate into actions. If not faced, these potential vulnerabilities might make the global progress towards a green energy future slower and more expensive».

Currently, revenues from coal production are ten-time higher than those connected with the protagonist minerals of the energy transition: the real “oil” of the XXI century.

An onshore wind power plant needs nine-times more resources than an electric gas station of similar sizes, the expansion of electric networks requires a huge quantity of copper and aluminium whereas an electric car needs six times the mineral inputs of a conventional car.

The demands by the energy sector for the above-mentioned critical minerals might «increase by up to six times by 2040, depending on the rapidity of Governments’ actions to reduce emissions», and this massive increment in absolute terms will unavoidably influence the rate of the energy transition itself.

Is an electric air-taxi about to become reality?

It can reach speeds of 320 nodes (593 km/h) and fly up to 500 nautical miles (926 kilometres) with a single battery charge, plus 45 minutes of IFR reserve.

We are speaking of eFlyer 800, the fully electric aircraft by Bye Aerospace, which can host up to 7 passengers and two pilots.

The French Safran Group is collaborating in the development of the eFlyer 800, for both the propulsion system with its “ENGINeUS” motors and for the “GENeUSGRID” energy management system.

At present, we just know the electric craft will be equipped with two motors and it could be able to fly up to 35,000 feet, the equivalent of 10.6 kilometres.

It seems that Quantum Air is planning an air taxi service precisely with these aircrafts.

«The eFlyer 800 – explains George E. Bye, founder and Ceo of the company – is the first all-electric propulsion technology airplane that achieves twin-turboprop performance and safety with no CO2 and extremely low operating costs. This type of remarkable economy and performance is made possible by the electric propulsion system and advanced battery cell technology that results in significantly higher energy densities».

Energy transition: searching for skills

The presence of electronic and electromechanical components in machinery, and therefore in industrial processes, has been rising for some time now in manifold sectors and its growth goes on hand in hand with 4.0 systems. To comply with the trend, it is necessary to create a new generation of skilled professionals

Not only transports: the manufacturing industry in general is concerned by the increasingly massive presence of motors and drives that exploit electric energy instead of the more conventional hydraulic and pneumatic systems.

Besides, it is common opinion that the higher electrification of manufacturing activities or of the building sector might lead – as calculated by Bloomberg NEF in a recent report – to the 60% decrease of greenhouse-effect gases by the half of the century.

Certainly, as highlighted by Enel and Turin Polytechnics in a research presented last December, the secret resides in the will and capability of the various stakeholders of giving birth to an integrated strategy.

What, in other words, the energy provider and the University identify with the expression, the triangle of electricity, at whose vertices we can find renewables, electrification of final consumptions and efficiency of digitalized networks.

Expectations are high: the study estimates that within the next biennium the above-mentioned renewables can represent almost half of total provisioning sources (48%) while from now to 2050 the consumption electrification should reach percentages by 42, 41 and 53% respectively in the ambits of general industry, mobility and residential.

Irrespective of the future possible scenarios, the irremissible matter is that skills are needed to manage them.

And they are not the manifold innovative skills that have been a topical theme since the dawn of Industry 4.0.

The dear old electrotechnics is instead at stake, implemented and refined by a degree in electronic engineering that is in itself synonym of certain employment.

This is the belief – and we will see it hereunder – of the secretary of ANIE Automation and ANIE Energy Marco Vecchio, who however started from other reflections for his interview with Electric Motor Engineering.

Different requirements in the various sectors

«We monitor», Vecchio stated, «the electrification process in mechanics and mechatronics, that is to say how products of this kind converge then into chains like machine manufacturing.

It is an indicator of the trends that enliven the transition from hydraulics to electrical-electromechanical.

From 2013 to 2019, the percentage of electromechanical and electronic components increased by 7% yearly versus the value of machines themselves, also due to the contribution of drives and motors.

For some applications, electromechanics assures more efficiency than hydraulics but this does not mean it is the absolute best option.

It depends on application sectors and fields. In the future, electro-hydraulics grants more energy efficiency and durability, as well as controllability inside a supply chain.

However, it is more correct to say that if in some cases electromechanics is winning, hydraulics and hydraulics-pneumatics is the winner elsewhere».

For instance, «where remarkable performances are imposed – I think of machinery and packaging with their requisites of motion control that mandatorily need a significant contribution by electronics» then «we can affirm the automation injection has quintupled in the around last ten years».

On the contrary, traditional mechanics is still the privileged choice for more basic operations and fields, such as woodworking and textile.

Concerning environmental impacts and consumptions, Marco opportunely preferred making some distinctions.

«There is efficiency enhancement, he pointed out, «and this implies a lower energy demand, although basically electric motors have some of the highest consumptions, no matter what their application field is, from white goods to automotive».

A matter of class

Their subdivision into categories by requirements, the assignment of a precise energy class also to drives and inverters, is one of the aspects at which associations like ANIE have worked in collaboration with institutions. This has resulted in a regulation on eco-drives that will come into force since next July (2021/341).

«In cascade», the number one of ANIE Automation and ANIE Energy added, «we expect regulations about pumps and other parts and on their efficiency, to be read according to a vision of systemic approach and not just for the single component».

Regarding renewables and the European New Green Deal, Vecchio is cautious: «What is contained in the national recovery and resiliency Plan about the green source theme is important.

Nevertheless, the problem is that to concretize the goal of the national Climate-energy Plan, the installation of renewables should increase by six times yearly from now onwards.

We unceasingly dialogue with institutions also in this field, in the attempt of overcoming the hindrances of the well-known NIMBY effect».

The shift to green in its turn needs competences. Therefore, developing them becomes fundamental for the Country system, as well as for the players engaged in various capacities in the energy sector.

An investigation about employment carried out in 2020 revealed that among the 121 students who in 2018 graduated in Electric Engineering at Milan Polytechnics the employment rate was by 96% one year after the degree; in 90% of cases within six months and prevailingly (70%) with permanent contracts.

Commenting the statistics, Vecchio had specified that «electrotechnics should be among the primary choices for a young graduate who approaches University», while «data coming from Italian Universities and associated companies highlight that finding human resources on the market with these skills is instead very difficult».

After some time, the opinion has not changed.

«We are dealing with an important energy and industrial evolution», Vecchio stated, «and we need professionals who can manage it. Digital is strategic and very topical; the so-called soft skills are essential, but if it is true that complexities rise, it is as true that we need people who can face all-round complexities and be problem solving. New professionalisms are precious, provided that we do not forget the tradition of electrotechnics, which has its own specialties, problems and peculiarities. To put it in a joke», he ended, «the knowledge of digital technologies is indispensable but also the acquaintance with a transformer».

(by Roberto Carminati)

United Kingdom: electric vehicles drive the recovery

The British automotive market has not completely overcome the repercussions of lockdown but in Spring the sales of BEV and plug-in reached record levels. Meanwhile, the growing diffusion of cheaper models leads the Government to review its dedicated incentive programme.

The data concerning the market trend last March, provided by Society of motor manufacturers and traders, SMMT, leave no doubts.

In the United Kingdom, the sales of full-electric and plug-in vehicles represent almost 14% of the total, while in the same period of last year they did not exceed 7.3%.

Reported also by sources such as The Guardian, SMMT has calculated that in such period Her Majesty’s subjects purchased about 22,000 units of battery-powered cars and other 17,000 hybrid models, in the course of a particularly critical year for industry and trade.

At the end of the first quarter, registrations were dropping by 37% versus the average of 450,000 regularly maintained in 2010 and 2019.

Although we have witnessed their upswing (+11%, worth 284,000 new registrations), the losses suffered since the first phases of Covid-19 diffusion were huge indeed, amounting to, in money terms, over 22 billion pounds.

The negative peak was reached in April 2020, when the total sector turnover dropped by even 97%.

Surpassing France

If we look at the e-mobility behaviour along the entire first 2021-quarter, further surprises emerge.

From January to March, about 31.800 BEV were delivered, 7.5% of overall sales: the double of what estimated just twelve months ago.

The exploit has allowed Great Britain, at least in the zero-impact mobility field, to surpass France, where, according to some independent analyses, the threshold of 30.500 units was not overcome. Germany is still distant, with its record share of about 65,000 electric cars marketed in the 90 opening days of the current year, but the step forward is undoubtedly significant and the trend is likely to consolidate.

Germany is still distant, with its record share of about 65,000 electric cars marketed in the 90 opening days of the current year, but the step forward is undoubtedly significant and the trend is likely to consolidate.

This is mainly due to Boris Johnson’s decision of undertaking the decarbonization way.

In their turn instead, UK citizens, officially called to give up old diesel or petrol engines by 2030, pose at least some not negligible conditions.

We want columns

Our domestic general press as well has rightly highlighted a survey among consumers that SMMT has commissioned to the specialized company Savanta ComRes, regarding the reasons in favour or against the purchase of an electric vehicle.

It emerged that 37% of interviewees are ready to buy it within 2025, but also that other 44% would willingly delay the shift to 2035.

Finally, 24% would not change their conventional internal combustion engine with a zero emission one.

Undoubtedly, higher prices weigh (52%) but also the scarce presence of recharge stations on the territory (44%) that goes hand in hand with the fear of remaining on foot during longer journeys (38%).

Not fortuitously, the numerical increment of charging stations is one of the demands addressed to Downing Street by manufacturers and induced activities in recent times, estimating in 16.7 billion pounds (equal to over 18.5 billion Euros) the necessary investments for the creation of a really satisfactory network, spread in sufficiently capillary way.

Spending or not spending: this is the dilemma

A real enterprise, we daresay, considering that in the current year’s spring we could count fewer than 19.500 columns in operation whereas at least 1.7 million would be necessary by 2030 to hit the challenging target of 2.8 million five years later.

To achieve that, we should activate as many as 507 recharge places a day during next fifteen years.

Going back to the Society of motor manufacturers and traders, among the desiderata submitted to the premier there is also the restoration of the bonus for the purchase of those hybrid plug-in that on one hand assure undisputable environmental sustainability advantages and on the other hand grant more certainties in autonomy and mileage.

However, precisely in the incentive matter, Johnson’s executive seems to have triggered a partial reverse.

The essential idea is that nowadays the offer of models with retail cost under 35,000 pounds has widened by over 50% and therefore the concessions that previously concerned the tariff range between 35 and 50,000 can be eliminated.

Still in force instead – the provision is dated March 18th – the incentives in favour of those who intend to shift to hybrid or electric under 35,000 pounds, although decreased from 3,000 to 2,500 pounds.

It is a Country for start-ups

According to what reported by specialized British sites, the Government believes that the owners of sufficient resources for a high-end four wheels do not need a subsidy from taxpayers.

Beyond the respective price lists, it is sure that in the UK panorama the proposal of green vehicles is becoming richer, due also to the aggressive entry into the arena of some ambitious start-ups.

Among them, undoubtedly stands out the London Arrival, headed by the founder and CEO Denis Sverdlov, with a recent début at NASDAQ with an estimate worth 13.6 billion dollars, the highest than ever for a British debutant at the New York Stock Exchange.

1,800 employees spread in Great Britain, United States and Germany, next summer and winter it has planned the first road tests – and with passengers on board – of its electric buses and vans.

What more matters and more attracts investors is its business paradigm made up of highly scalable and flexible factories, close to potential customers; and of technologies and components fully in-house designed and manufactured.

A strategy that should aid it in decreasing manufacturing costs by 30%, and in approaching the market with an aggressive proposal.

Therefore, suiting a scenario where the competition in e-mobility is intensifying.

(by Giuseppe Fazio)

The great challenge of the supply chain

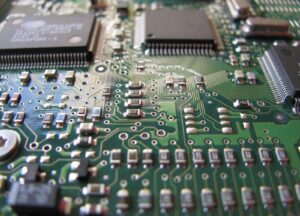

In the whole industry, we risk a trend of price rise, owing to the pressure of the provisioning chain costs, especially of raw materials. However, the crisis in course of the current semiconductor supply has ancient roots. We are analysing the reasons with Andrea Rossi, Managing Director of Ics Industrial, Milanese reality introduced in the Chinese scenario, in Shenzhen. From shortage to counterfeiting, from the chip hoarding to the price escalation.

Everybody knows the industry of semiconductors is living a crisis because of an intrinsic difficulty in the provisioning of components and that it will still last for a long time.

Those who have decided buying a car (delivery delays: nowadays chips are the component number one) or have tried repairing a household appliance are aware of the crisis related to the difficulties of semiconductor provisioning.

Among the known causes of the difficulties that are affecting semiconductors’ world, pandemic ranks first, as well as especially the effect it has produced on the entire supply-manufacturing chain of semiconductors.

Since the beginning of 2020, fewer cars have been sold but many more computers and electronic devices for smart working: the market has displaced its focus and now, when things are trying to recover the previous situations, the balance of power has changed.

Meanwhile, 5G has started worldwide, with the inherent consequences in terms of IoT, edge computing and of the countless applications of the Artificial Intelligence.

Anyway, there is perhaps something more, less functional and more geopolitical.

Like the tug-of-war between China and USA (where semiconductors are the fourth sector by export, after aerospace and petroleum, crude and refined) owing to matters of duties and balances on the big market, where also Taiwanese companies operate (such as Tsmc) and Korean (like Samsung).

Besides, the Semiconductor Industry Association has recently communicated that in 2020 the demand for semiconductors grew by 6.8%, (worth 440 billion dollars), with a notable growth rate for a mature sector.

A number that not only kept on rising in the first 2021-quarter, but it even doubled (+12%) and is likely to grow further. Analysts, even the most conservatory, report +19% by the end of the year.

Such data have not emerged for at least ten years in the semiconductor sector.

The floor to a semiconductor expert who knows China

This is the picture. However, the existence of something more is witnessed by Andrea Rossi, managing director and founder of Ics Industrial, reality headquartered in Milan, whose name stands for “I Choose Shenzhen”.

A declaration of intent in the brand, because, Rossi explains, “Shenzhen is the global capital of the hardware business: 90% of world electronics is traded there”.

What is the mission of an Italian Milanese company in Shenzen?

We were born to allow companies in various sectors to eliminate superfluous stages in the purchase process of electronic components.

Our peculiarity consists in our partnerships rooted in Shenzhen. They are the components mounted on Printed Circuit Boards (Pcb).

They are split into active and passive components and the present crisis mainly affects semiconductors, then active components.

Who generally buys electronic components?

They are manufacturers addressing a broad range of sectors: automotive, electromedical, decoders, measuring and control instruments, smartphone, pc, laser cutting machines, conditioners, air purifiers and inverters.

Whatever product that contains electronic boards, in other words. Moreover, some companies assemble the boards, then they mount the components in printed circuit boards for some enterprises in the above-mentioned sectors, and they are called subcontractors.

Whom do the companies that buy components generally address?

They rely on two ways. One consists in official distributors (big Groups, like Arrow and Avnet).

They distribute the major semiconductor brands (ST, NXP, Microchip, Texas Instruments and many others).

At present, they miss endless parts in stock.

Then there are local Italian or European brokers.

They buy from China, although they are reluctant to communicate it to customer companies (some of them still confuse the Made in China with understanding that Shenzhen is the Silicon Valley of hardware).

In their turn, local brokers turn to Asian brokers, with consequent high prices for end-users.

We directly address stock holders in the primary global market, that is to say Shenzhen.

What is happening in the market of semiconductors?

The global market of semiconductors is shocked by the unavailability of fundamental components for the product implementation.Components are identified by a part number: fundamentally, an alphanumeric code.

Currently, it is very difficult to trace many part numbers. Official channels indicate delivery terms (called lead times), sometimes of 26 or even 52 weeks, without the certainty they can be respected.

Currently, it is very difficult to trace many part numbers. Official channels indicate delivery terms (called lead times), sometimes of 26 or even 52 weeks, without the certainty they can be respected.

How did this come about?

Semiconductor producers manufacture a lot in China. Last year, in March and April, at the peak of the Chinese lockdown, factories had interrupted or considerably slowed down the production.

The long wave is coming now.

During 2020, especially two sectors increased the demand for components: electromedical and remote telecommunications.

The first due to the need of producing devices contrasting the pandemic: let us just consider respirators but also thermometers and oximeters.

The second because the smart working has needed and will require huge investments in technologies.

The global stocks of available components for the other sectors have notably decreased and damages have emerged just during these weeks.

These causes have led to a widespread difficulty of provisioning fundamental parts for the manufacturers of products containing electronic material.

Why have components’ prices boomed?

The holders of semiconductors’ stocks naturally handle something strictly resembling gold.

Prices are in constant upswing: we have witnessed quotations up to 10/15 times the market value in normal times.

The owners of determinate part numbers, deemed popular and appealing, sometimes refuse selling, to make the price further rise in the market.

Does the counterfeiting problem exist?

As it is difficult to find components, the market of counterfeited products, which was thriving already before the semiconductors’ crisis, is living a high-rate expansion.

Asian companies are committed to reproducing the wiring diagrams contained in technical data sheets of original components and to producing counterfeited components by labelling chips’ surfaces with markings that follow original ones.

With the result that it is sometimes arduous to recognize an original component from a counterfeited one.

This happens also to an electronic engineer or to a sector expert.

This happens also to an electronic engineer or to a sector expert.

Nowadays the techniques used are very refined.

Once mounted on the boards, two scenarios can occur: the component works or it provides uncompliant values, not conforming to the technical data sheet.

In this second case, the damage has already taken place: time and human resources will have to be used for the board reprocessing.

Let us imagine, for instance, a production batch made up by 5,000 units: the damage can be enormous.

From your observatory on Shenzen, what is and what will the social impact of semiconductors’ crisis be?

The consequences of this crisis have a direct impact on the delivery terms of finished products, on employments and on prices.

Many customer companies, with which we have established excellent human relationships characterized by cordiality and mutual esteem, call us to express their concern for the dramatic consequences that this crisis will generate in case of its long duration: redundancy fund, possible layoffs and loss of important job orders for the company’s survival.

Green cars grow by 90%

The Focus of Anfia Study and Statistics Area on the market of alternative power supply cars in EU-Eft (International Association composed by Switzerland, Norway, Liechtenstein and Iceland), highlighted a notable growth of alternative power supply vehicles in the first 2021-quarter.

Overall, 1,046,560 hybrid and electric cars were registered, representing over one third of the market (34%), volumes doubled compared to the same period of 2020, when they were 542,000, with the 17.7% share.

More than 3 millions were the new registrations in all, in line with the volumes of the first 2020-quarter (+0.5%).

Compared to one year ago, petrol cars diminished by 19.1% and diesel ones decreased by 23.4%. On the whole, instead, the cars with alternative power supply grew by 90%.

In detail, Phev scored the most significant growth (+154%), followed by standard hybrid (+90%) and by battery electric (+55%). Natural gas cars are the only vehicles with low emissions that decreased versus 2020 (-11.3%), but they constitute a very marginal part of the market (0.5% of the market.

Stellantis stakes on Italy, next step the gigafactory in Termoli

On the occasion of the recent EV 2021 Day event, Stellantis has announced that in Termoli (Molise, Italy), it will be built the third gigafactory in Europe, after those in France and in Germany. It is at stake the conversion of FCA production plant in Molise, established in 1972 and specialized in the production of motors and transmissions. The mission of the factory, which employs 2500 workers and takes up an area of 1.2 million square metres, will be producing batteries.

The young Group’s investment will amount to over 30 billion Euros by 2025 in electrification and software. «The target of Stellantis – stated the CEO Carlos Tavares – is that electrified vehicles succeed in representing over 70% of sales in Europe and more than 40% of those in the United States within 2030. Besides, in the future of Stellantis there are four platforms for electric ones and also sound-state batteries. The requirements of batteries and components for EV by Stellantis will be satisfied by five gigafactories in all and the plant in Termoli represents a consistent choice in the context of the course of Stellantis, which is supporting the energy transition of all of its Italian industrial sites, with the aim of assuring their sustainability through the improvement of their performances and to make the Country play a strategic role among the primary domestic markets of the Group.

Innovation in the rotor cooling: here is the new motor by Energica

Acronym of Energica Mavel co-engineering, the new EMCE motor will be exclusively used on the whole Energica range. The two protagonist companies are Energica Motor Company and Mavel, a research, development and production company specialized in the powertrain ambit that is headquartered at Point-saint-martin, in Valle D’Aosta (Italy).

The company collaborates with primary OEM on a world scale in the automotive industry, but with Energica it makes its début in the two-wheel sector, therefore it has helped Emilia player in improving the motor performances.

The new EMCE contains innovative geometries of rotors and stators that minimize energy losses and maximize performances. The uniformity of the delivered torque and the weight optimization improve the power density and the torque of the motor and permit the optimization of manufacturing processes. Moreover, an innovative patented rotor cooling can generate an internal airflow that touches magnets and cools them, permitting the motor to exploits its potentialities also at high speeds. Furthermore, some adaptive control algorithms assure the inverter can always make the system work in the most efficient possible way. Due to the new EMCE motor with power peak at 126 kW, with 8500 rpm and liquid cooling that grants the highest performances, Energica range is lightened by 10 kg, with relative autonomy rise that ranges from 5 to 10%.

«Innovation – declared Giampiero Testoni, CTO of Energica Motor Company Spa

is the main core of our technical department that, together with Mavel, has found the right collaboration to go even beyond the limits of the current technology, further improving an already highly performing product. The progress is what leads us to look further, to full advantage of our final customers. We are proud of setting a new important technological progress in the Electric Valley that, day by day, we are implementing with so much commitment and passion».

The witness by Davide Bettoni, CEO of Mavel, is as enthusiastic: «I believe in the collaboration between Energica and Mavel because they are two companies projected towards the future, with complementary technologies and converging visions. I am also proud that two realities like ours, which invest in people, contribute in supporting a future of modernity and development for our Country».