Oldrati Gomma Line is the nascent joint venture that can boast the synergy with the sound expertise of Gomma Line in the production ambit of extruded rubber and metal products, and with the technological and innovation know-how of Oldrati Group.

The decision of shaking hands taken by Oldrati Group and Gomma Line, two relevant realities in the rubber industry panorama, aims at creating synergies that will lead to new opportunities in East Europe and Russia markets.

Topicality is clear: in 2019 a free trade agreement was signed between Serbia and the Eurasian Economic Union, whose primary Country is Russia.

Gomma Line has operated on the market for about fifty years, with a strong specialization in rubber extrusion and moulding processes and with manufacturing sites in Serbia and Russia, whereas Oldrati Group, with almost sixty years of history, is one of the leader international Groups in the production of rubber, plastic and silicone goods, moulding and assembling, boasting a multimarket ranking.

In addition to productive synergies for the manufacturing of finished items, the agreement also provides for a collaboration verticalization: Gomma Line will have the opportunity of benefit- ting from the Compounding Division of Oldrati Group and from the competences of the Materials Team, so enhancing the supply chain’s force and extending the technological service on materials.

Rubber and metal extruded products for the international market

Here is the hybrid tractor for agriculture

It is called REX4 Electra the hybrid tractor by Landini brand, trademark of Argo Tractors Spa company, multinational of Argo industrial Group headquartered at Fabbrico, in Reggio Emilia province.

The vehicle, intended for crossing fruit and vegetable fields in a sustainable way, has won the Technical Novelty Eima International, too.

Propulsion is dominated by the 110 HP diesel engine that, through the generator and the battery, powers the two front electric motors, which deliver 12-kW power that can rise to 16-kW for each wheel.

In REX4, the novelty is positioned in the “bow” of the tractor, with fully electric front-wheel drive on suspended axle and sensors, electronic controls, generator and battery dedicated to the Brake Energy Recovery, the energy recovery in braking and deceleration phases.

The system, which is called Electra Evolving Hybrid, is managed by PMS, Power Management System, which supervises the operation of all devices, battery included.

What are benefits in terms of performances? We will achieve the 10% fuel saving, the 15% steering angle improvement, the 15% vibration reduction and higher transport stability.

Boom of electric motors: the demand for minerals is rising

The last report “The role of critical minerals in clean energy transitions”, published by the International Energy Agency (IEA) has highlighted that the necessary energy transition will imply a further stress on material flows for many minerals.

Flows that never stop: the global mining of raw materials has increased by 3.4 times since 1970, rising from 27 to 92 billion tons yearly, with the addition of just 8.6 coming from recycling.

«Data – Fatih Birol, executive director of IEA, explained – show an incumbent gap between the world’s strengthened climatic ambitions and the availability of critical minerals that are essential to implement such ambitions. Challenges are not insurmountable but Governments must give clear indications about how they are transforming their commitments to climate into actions. If not faced, these potential vulnerabilities might make the global progress towards a green energy future slower and more expensive».

Currently, revenues from coal production are ten-time higher than those connected with the protagonist minerals of the energy transition: the real “oil” of the XXI century.

An onshore wind power plant needs nine-times more resources than an electric gas station of similar sizes, the expansion of electric networks requires a huge quantity of copper and aluminium whereas an electric car needs six times the mineral inputs of a conventional car.

The demands by the energy sector for the above-mentioned critical minerals might «increase by up to six times by 2040, depending on the rapidity of Governments’ actions to reduce emissions», and this massive increment in absolute terms will unavoidably influence the rate of the energy transition itself.

MECSPE Observatory. The key factors to recover

Resilient, ready to change and to accept challenges, even the most unexpected ones, relying on their resources and capability of looking ahead, despite the particular time: this is the picture portrayed by MECSPE Observatory survey.

We are certainly facing an unprecedented period, which marks a decisive gap between those who had been able to adopt in advance the digital change and those who found themselves unprepared, so being more affected by the effects caused by the pandemic on industry.

The analysis reveals a transitory phase, where the confidence in one’s own corporate situation almost reaches the sufficiency but scepticism and uncertainty about the general scenario remain. Almost two thirds of the sample fixes one year maximum of time to restart at full rate.

Innovation remains the key factor to recover, together with the training of specialized young and a growing attention to sustainability.

Desire of living normality again: 35% of interviewees believe that exhibitions should necessarily involve the alive participation.

Covid-19 pandemic has unavoidably influenced the performance of Italian SME, exerting a negative impact on almost 9 companies out of 10. However, if 14% of entrepreneurs state they have already recovered normality completely and 65% are going to do that within one year maximum (23% within 6 months), the general confidence index surveyed by the investigation makes Italian enterprises’ sentiment, in a scale from 1 to 9, rank on an “average” level versus the current situation.

Digital and new technologies to react to the crisis: resilience weapons

Last months have witnessed a necessary digital acceleration, especially in lockdown phase, for those who were not compelled to stop manufacturing activities for a period, corresponding of 62% of interviewees.

A boost promptly suited by 6 companies out of 10, succeeding in reacting promptly to the crisis through the investments made some time ago in new technologies and the deployment of useful instruments for the social distancing:

· platforms for the remote management of meetings, adopted by 36%;

· design technologies to redesign the new spaces of the 4.0 factory in conformity with safety requisites (10%);

· virtual systems that allow the control from remote of operational activities (7%);

· platforms of collaborative design and manufacturing process simulation for the development of the whole product (5%);

· apps and software to localize and to trace the paths of people in the factory (4%).

Moreover, the resilience of manufacturing companies is proven also by the choice, already made or under evaluation, of shifting the production towards other sectors (12%), as well as by timely provisions carried out in the course of the emergency phase, such as safety plans drawn up to avoid contagion risks (55%), the introduction of smart/flex working modalities (43%), with 34% providing for the reduction of operating costs, 29% who went on investing in innovation and new technologies and 19% who focused on the corporate training from remote.

Moreover, the resilience of manufacturing companies is proven also by the choice, already made or under evaluation, of shifting the production towards other sectors (12%), as well as by timely provisions carried out in the course of the emergency phase, such as safety plans drawn up to avoid contagion risks (55%), the introduction of smart/flex working modalities (43%), with 34% providing for the reduction of operating costs, 29% who went on investing in innovation and new technologies and 19% who focused on the corporate training from remote.

Consequences that have probably led to the choice, for almost half of them, of going on investing, by the yearend, up to 10% of their turnover in innovation, with 17% of interviewees who are going to achieve from 11% to 20%.

Mecspe Observatory: staking on sustainability and on specialized young

To overcome this moment and to start growing economically again, almost 8 entrepreneurs out of 10 believe it is important to focus on sustainability, too. Among the aspects already most cared, the consumption reduction ranks first, indicated by 61% of interviewees, followed by social responsibility projects (53%), by the attention to pollution and environmental impact, by the ethics in the relationships with suppliers and customers (52%). Importance is acknowledged also to the support to the territory economy (35%), and to the product eco-sustainability (30%).

The new phase, in the name of the fast race of digital processes, has consequently disclosed new opportunities to engage and to train more young workers in factories. If on one hand 26% prefer not providing for employments of this kind at present, 20% are evaluating the engagement of young specialized in the field of 4.0 technologies, coming from Technical Institutes or Universities, or with a basic working experience. Furthermore, 13% are organizing in-house training courses for the young workers already engaged by the company while 9% are evaluating to employ young even without a previous scholastic or working education but providing for in-house specific training courses.

The new phase, in the name of the fast race of digital processes, has consequently disclosed new opportunities to engage and to train more young workers in factories. If on one hand 26% prefer not providing for employments of this kind at present, 20% are evaluating the engagement of young specialized in the field of 4.0 technologies, coming from Technical Institutes or Universities, or with a basic working experience. Furthermore, 13% are organizing in-house training courses for the young workers already engaged by the company while 9% are evaluating to employ young even without a previous scholastic or working education but providing for in-house specific training courses.

Exhibitions and events, astride on and off-line experiences

Digital talks, webinars and virtual events. Users seem to appreciate the numerous business initiatives conceived in digital version in recent months for companies and professionals owing to the imposed situation, mainly for safety matters (21%), but the off-line remains the preferential channel.

Although they judge the online a valid alternative, 27% of interviewees continue to attend live events, and 35% believe that soon the digital experience of exhibitions will necessarily be combined with the physical experience again, already since next Autumn, with traditional trade fairs.

High-Efficiency Motors and Testing

“High-Efficiency Motors and Testing” is the first event of the “Electric Motors Talks”, a cycle of virtual meetings dedicated to the Coil Winding Community, and it will be in live streaming Thursday 14th April 2021, from 10:30 p.m. to 12:00 p.m.

The webinar will be chaired by Marco Villani, professor of Electric Machines Design and Electric Systems for Mobility at University of L’Aquila and technical director of Electric Motor Engineering review.

It is a joint initiative of University de L’Aquila and Coiltech to promote the exchange of expertise between specialists in Coil Winding and related fields, making at least part of the World Magnetic Conference accessible online, in this exceptional time.

14 April 2021, 10:30-12:00

Edoardo Fiorucci – University of L’Aquila

Issues about the uncertainty evaluations in efficiency measurements: the case of the separate losses in induction motors

Alberto Rubino – Spin

A new generation of high-efficiency, silent & rare-earth free reluctance motors

Dragana Popovic Renella – Senis AG

Fast Magnetic Angle Sensor For Smooth Motor Control

Alberto Tessarolo – University of Trieste

Regenerative full-load testing of modular high-power machines: an alternative to the back-to-back method

Elaphe and McLaren, together to develop a new electric motor

The Slovenian manufacturer of electric motors Elaphe and McLaren Applied have established a strategic partnership. The target is developing a propulsion group that combines the motors in Elaphe wheels and the vehicle control with inverter technology by McLaren Applied. Actually, Elaphe will use the 800-V silicon carbide IPG5 inverter by McLaren. Actually, Elaphe will use the IPG5 800-V inverter made of silicon carbide by McLaren. Partners affirm that their combined electric traction would offer notable space and weight saving to automotive companies, with vehicle’s low energy consumption and five-time faster torque response than existing systems, to be ascribed to the minor installation space of the transmission.

Current Elaphe motors in wheels show torque density up to 460 Nm/litre and 100 Nm/kg. At the same time, the company affirms that their motors will offer high control bandwidth of each wheel, allowing customers to define and to modify the drive character of their electric car through the software development.

Electric doubling for Audi

At the end of the year, Audi takes stock and very proudly announced that in 2021 the brand has doubled the BEV models in the range and that, in 2022-2026, 37 billion investments in research and development, estates and factories are foreseen.

Out of them, 18 billions are intended for the offer electrification and hybridization. The way is therefore clear and connected with the issue of the recharge infrastructure, with an acceleration of the network expansion and installation of the first Audi charging hub in Nurnberg.

Starting from 2026, Audi will introduce just new full-electric models on the global market, whereas the production of thermal motors will end by 2033.

The latest introductions of electric models concern Granturismo Audi e-tron GT quattro and Audi RS e-from GT and the compact SUV Audi Q4 e-tron and Audi Q4 Sportback e-from. Within 2025, Audi will rely on over 20 purely electric models.

«Within 2030, Audi aims at offering a real electric ecosystem to the customers of BEV vehicles. The Vorsprung 2030 plan – explained Markus Duesmann, CEO of Audi AG – will allow the brand to face and to win the challenges of the future. The changes inside the civil society are following one another at a dizzying pace: for this reason, we are accelerating our transformation».

Electric cars: accelerating the spread?

A new study by mOve laboratory at the Politecnico di Milano has shown that there is an immediate opportunity to move a step forward even without waiting for the development of a public charging network.

The investigation has shown that there is an immediate opportunity to accelerate the spread of electric vehicles, even without waiting for the development of a public charging network.

The results

Around 13% of all private vehicle owners could purchase an electric car immediately, without changing their habits, with the most likely availability of a home charging point and breaking even on costs in comparison with a petrol-driven car in less than 8 years (with the current government incentives offered on their purchase and road tax).

The research is considered highly statistically reliable as it is entirely based upon real data: over 100 million trips in private vehicles, monitored over a period of 12 months, were analysed.

The researchers at the mOve laboratory obtained the results by cross-referencing an analysis of the distances covered, an in-depth economic assessment of the purchase of an electric car, and a geographical analysis of the location of the subjects’ homes to quantify the probability that they would actually have a home charging point available.

The analysis

According to the analysis of the distances, a sizeable 50% of private vehicles never make daily trips lasting longer than the battery life of the car (assumed to be around 300 km/190 miles in practice) over the course of the entire year, thus making it possible for them to make the switch to an electric vehicle without any changes in habits or usage limits, as long as they have a home charging point available, be it private or block-owned.

The study then went into greater detail with the analysis of this 50% of vehicles which are functionally ready to switch to electric, using an in-depth economic assessment (purchase costs, energy costs, road tax and insurance costs, depreciation, etc.) of an electric car compared to a petrol-driven equivalent.

One final study was carried out and cross-referenced with the others: a geographical analysis of the location of the subjects’ homes to quantify the probability that they would actually have a home charging point available.

By introducing this limitation, the percentage of total vehicles in the fleet that would be “immediately ready” to purchase an electric car was estimated to be 13%.

This opportunity could be further increased by encouraging car-sharing systems, making it easier to reach the economic “break-even” point for electric cars, and consequently reducing the need to introduce incentives.

Safety is crucial

For the development and the diffusion of vehicles equipped with autonomous driving systems, the safety matter is obviously central. The results of the research “Global Automotive Consumer study” by Deloitte have highlighted, for instance, that European consumers feel safer on an autonomous-driving car produced by manufacturers of the automotive industry than in cars proposed by hi-tech companies, thus revealing people’s trend to perceive brands already known and “tested” as more reliable. The safety of autonomous driving systems is a topic to which TÜV SÜD (independent body that operates in certification, inspection, testing, tests and training) has dedicated the “Driver Assistance Systems Conference”, held in Munich, in Germany, with the participation of over 200 engineers. Among the themes treated – as underlined Pietro Vergani, Business Unit Manager Consumer Product of TÜV Italia – they debated also the simulation issue, which will play a fundamental role in the future test and homologation activities. «Using these methods – he stated – test structures can assess daily up to 50 million scenarios: an unfeasible enterprise with physical tests on vehicles». Another subject discussed in Munich concerned the electronics of cars and these systems’ capability of imitating human behaviour.

Autonomous driving

The engineers attending the conference mentioned “neural networks”, i.e. a sort of artificial nervous system that allows machines or computers to learn autonomously, in compliance with the artificial intelligence vision. Besides, at the conference they presented IMAGinE project, which develops advanced driving assistance systems able to introduce support actions to the autonomous driving, too. Concerning instead platforms, the representative of an automotive company attending the conference underlined that “non-exclusive” ones will become more common in the future, they will be at disposal of various automotive companies and this will result in a reduction of costs, meanwhile making available a growing number of vehicles. Finally, in the opinion of Pietro Vergani, innovations also in car homologation methods will have to correspond to technological innovations. «We have analysed thoroughly new possible homologation approaches for autonomous-driving cars – explained Vergani – and we have inferred that virtual homologation methods, based on test simulation of virtual vehicles, are already reality and transposed by the legislation in course, even if not extensively and for dedicated approval ambits, like for instance the simulation of mechanical stresses on frames or underrun bars. Such methods, and the relative technical validations, are steeply rising and they will be the control basis for the vehicles of the next future».

E-mobility, the electric-vehicle disruption is inevitable

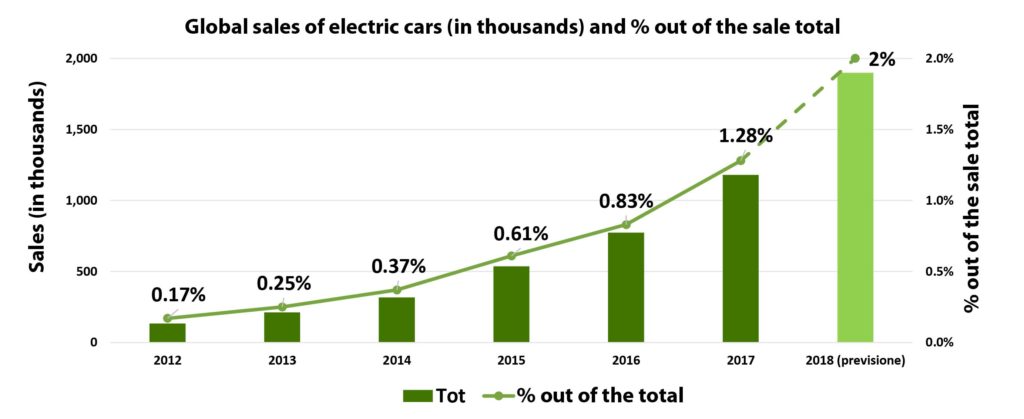

Almost 1.2 million electric cars sold in the world in 2017, the most positive result ever obtained, and it is expected that such trend will be confirmed for 2018 with 2 million new electric cars on the market. In Italy, the technological maturity is the reference indicator that shows fewer criticalities, on the contrary the regulatory maturity is the area with more gaps.

The E-mobility Report 2018, developed by the Energy & Strategy Group of Milan Polytechnics, managed by Professor Vittorio Chiesa, has highlighted the state of the art of the electric vehicle market in Italy, Europe and in the rest of the world.

The world situation

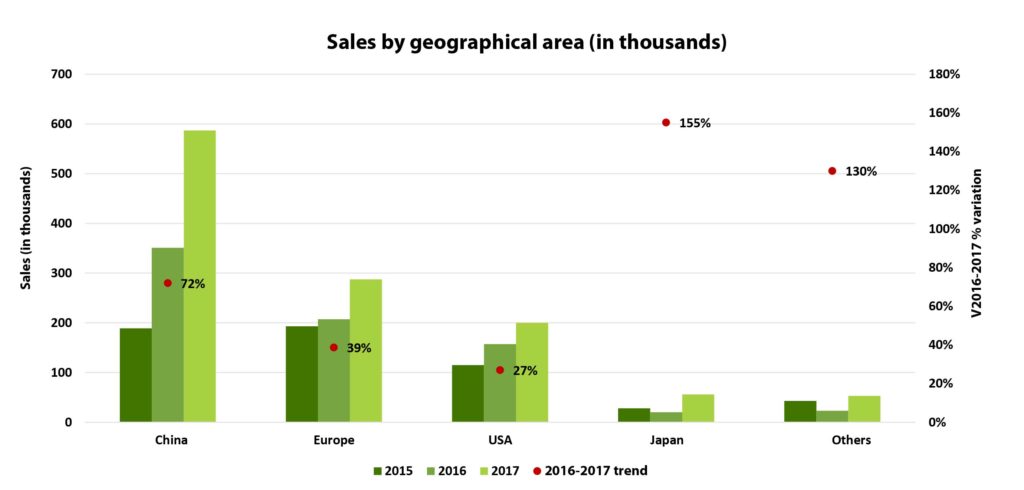

In 2017, almost 1.2 million electric cars were sold in the world, over 1% of the total of new registrations and 57% more compared to the 750,000 units in 2016. It is the most positive result ever achieved and it is expected that such trend will be confirmed for 2018 with 2 million new electric cars on the market. With around 580,000 cars sold in 2017 and a 72% growth versus the previous year, China is the biggest world market, overcoming Europe that confirms to be second in the ranking with almost 290,000 sold units and scoring the 39% increment. United States follow with 200,000 (+27%) and Japan is at the fourth place with 56,000 cars and a noteworthy +155% compared to 2016.

The e-mobility in Italy – specified Vittorio Chiesa – is not a market where the growth is missing. Absolute numbers are still small in comparison with other big European Countries but the sensation we can perceive among sector players is that the electric mobility is anything but an elitist fashion for lovers of sustainability and technology but it is instead becoming a fundamental component of the way of devising the transports of the future

In Europe

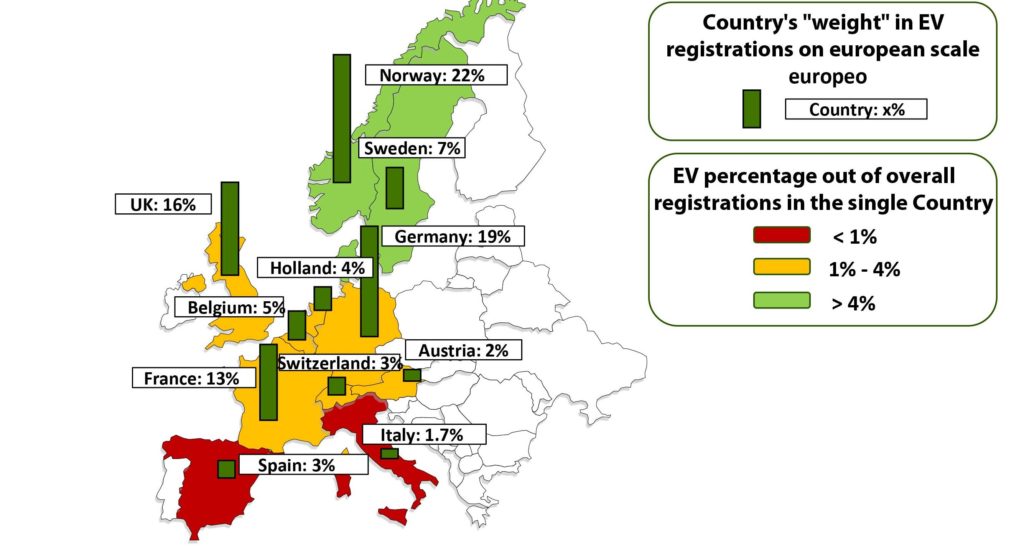

In European ambit, the first market is – indisputably – Norway, with 62,000 vehicles sold, that is to say the third Country by registrations after China and United States, but with a significant 39% out of the overall car sales inside the Country. Germany conquers the second position in the European market, with almost 55,000 registrations, over the double than in 2016 (+117%), also due to the direct incentive to purchase (4,000 Euros for a BEV, 3,000 Euros for a PHEV) and the exemption from the payment of the road tax for 10 years since the purchase time. Germans have surpassed the United Kingdom, which stopped at about 47,000 and +27%, third Country in Europe by registrations of electric vehicles (13% of the total) that offers a direct incentive amounting to 35% of the purchase cost, for a maximum of 5,100 Euros for a BEV and around 2,800 Euros for a PHEV, in addition to a reduction of yearly taxes. France follows with 37,000 and +26% and it directly incentives the purchase of an electric vehicle up to a maximum of 6,000 Euros, with a further incentive of 4,000 Euros for a BEV and 2,500 Euros for a PHEV if as replacement of a diesel vehicle with over 11 years of service life. These first four Countries attain 70% of the total in Europe.

In 2017, for the first time it was exceeded one million of cars sold on a world scale, over 1% of overall new registrations. We expect that such positive trend is confirmed for 2018, at the end of which 2 million new electric cars are likely to be present on the market

With around 580,000 cars sold in 2017 and a 72% growth versus the previous year, China is the biggest world market, overcoming Europe that confirms to be second in the ranking with almost 290,000 sold units and scoring the 39% increment

«In this ranking – explained Professor Vittorio Chiesa, director of the Energy Strategy Group of the Polytechnics – even if it has shown strong growth signs in 2017 and in 2018, Italy is still very behind and in 2017 it weighed by less than 2% in the European market of electric vehicles, against 13% of total registrations. The main hindrances connected with the take-off of the electric vehicle market are the high purchase cost of cars, the problems concerning the inadequacy of the recharge network and the limited autonomy».

In Italy

Italy is the third nation in Europe, preceded by Luxembourg and Malta, by number of per head vehicles. They have surveyed that there are over 7 vehicles every 10 inhabitants, one more than in France, Germany and UK, where this ratio is included between 5.8 and 5.9. Besides, the average age of a car of the fleet circulating in Italy is higher, with 10.7 years against 9 of France and Germany and 8.5 of the United Kingdom. In the light of these data, we can foresee a renewal that should lead to a significant adoption of electric vehicles. All that induces to think that in 2030 in Italy we might have 7.5 million circulating electric vehicles and a volume of investments amounting to 61 billion Euros.

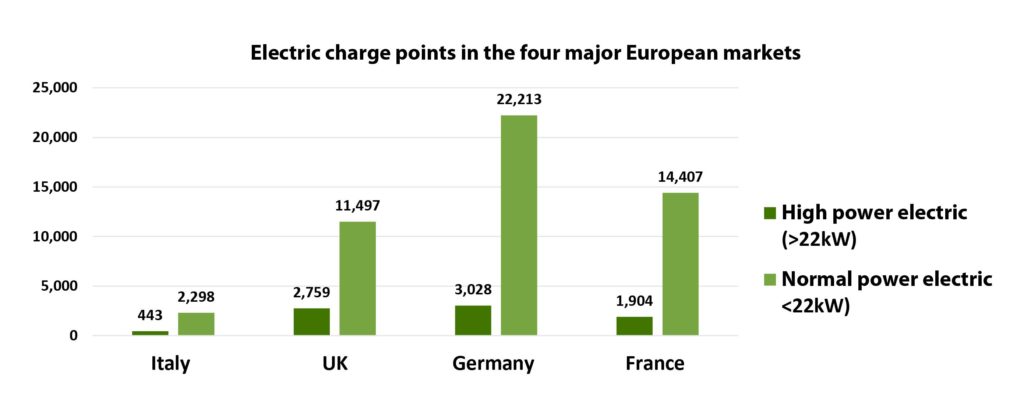

If we make a comparison between the recharge infrastructures in Italy and the rest of the Old Continent, the existing gap is evident, with a number of public charge points included betwween 10% and 20% compared to the 3 major European Countries

Let us see anyway the data already registered: in the first semester of 2018, almost as many electric cars as in the entire previous year were registered, and the same “doubling” was scored between 2017 and 2016. However, the Italian market’s size is small if compared with the global and the European market. In 2017, 4,827 electric cars were sold, 0.24% of overall registrations, thus achieving an approximate total of 13,000 units circulating in Italy at the end of the last year.

Out of 4,827 electric cars, 1,964 are full-electric, rising by almost 40% versus 2016. The remaining 2,863 are instead PHEV, 2.5 times compared to the registrations in 2016, surpassing BEV for the first time. In the first half of 2018, 4,129 electric cars were registered, +89% versus the same 2017 period and a number that approaches the entire year just past.

In European ambit, the first market is indisputably Norway, with 62,000 vehicles sold, Germany ranks second, with almost 55,000 registrations, followed by United Kingdom and France

«The e-mobility in Italy – specified Vittorio Chiesa – is not a market where the growth is missing. Certainly, absolute numbers are still small, slightly above the 4,000 vehicles in the last semester and also in relation to what is happening in the other big European Countries. The sensation we can perceive among sector players, however, is that the electric mobility is anything but an elitist fashion for lovers of sustainability and technology but it is instead becoming a fundamental component of the way of devising the transports of the future».

In the market of electric cars in Italy, the technological maturity is the reference indicator that shows fewer criticalities, the regulatory maturity is instead the area with more gaps. Incentives, if well proportioned, can act as enhancing instrument of the market competition whereas today in Italy they just regard the exemption of the road tax and the access to restricted traffic areas, with purchase incentives delivered on a regional scale only.

Infrastructures

At the end of 2017, in Italy it is possible to estimate about 2,750 public compliant recharge stations, grown in the course of the last year by around 750 units. This has resulted in the growth of the last years, drastically reversing a trend that instead had made the recharge units essentially stable from 2012 to 2014.

Moreover, it is worth pointing out a great ferment regarding new installations in the course of 2018, with partial data that indicate an even stronger growth than last year.

In Italy, in 2017, 4,827 electric cars were sold, 0.24% of overall registrations, thus achieving slightly less than 13,000 units in all circulating in Italy at the end of the last year

It is worth underlining a strong unbalance of the geographical distribution of recharge units: there is a relevant shortage in the South whereas Centre and North are more advanced but with even remarkable differences among the various Regions.

If we make a comparison between the recharge infrastructures in Italy and the rest of the Old Continent, the existing gap is evident, with a number of public charge points included between 10% and 20% compared to the 3 major European Countries: a litmus paper of the size of the electric vehicle market.