There is a brand-new agreement: la global automotive and industrial supplier Schaeffler has signed a five-year contract with Norwegian company REEtec AS for the purchase of rare earth oxides. The two have established a partnership to decrease the dependence on China precisely for rare earth metals for magnets used in electric motors.

Schaeffler has been producing electric motors on a large scale since 2021 and offers its customers power classes ranging from 20 kW to more than 300 kW. The company is focusing on sustainability along the entire value chain. Emission-free material production is an important step towards climate neutral operations by 2040.

The aim is to make electric motors for hybrid modules, hybrid transmissions and all-electric axle drives even more sustainable. Powerful permanent magnets manufactured using rare earth metals like neodymium produce optimum magnetic flux in electric motors.

In the future, Schaeffler will procure these metals from REEtec AS, which uses a sustainable production process. The partnership will begin in 2024.

Andreas Schick, Chief Operating Officer at Schaeffler AG said: «In REEtec, Schaeffler has gained a highly innovative partner that uses a novel and especially sustainable process for the production of pure rare earth elements. Rare earths play an important role in automotive and industrial segments. Schaeffler is focusing on achieving sustainability along the entire value chain and is systematically gearing its activities to the use of materials produced cleanly and sustainably. Through this partnership, we are also securing our supply of neodymium iron boron magnets for electric motors».

«We are delighted to have signed a five-year contract with Schaeffler and to be partnering with a globally successful market leader that prioritizes sustainability and transparency in the supply chain», instead the words by Sigve Sporstøl, CEO of REEtec AS.

Magnets, the European choice of Schaeffler

Green Vehicles, electric minibuses in Ancona streets

Specialized in the production of electric and hybrid vehicles, the innovative SME Green Vehicles will manufacture by 2026 nine electric minibuses for the public transport in Ancona, six of them already delivered in 2024. The new ecologic fleet will be implemented thanks to the RRNP, more precisely to the funds of the Next Generation Eu for the “Renewal of green bus and train fleets” of Italian Municipalities.

“These electric minibuses efficaciously support local bodies and companies in the transition towards a sustainable mobility. A simple solution that allows replacing existing vehicles with more eco-friendly means. The advantages will be notable also in terms of operation costs”, explained Enrico Cappanera, General Manager of Green Vehicles.

The vehicles with zero environmental impact, electrified by Green Vehicles and set up by Ristè, will be equipped exclusively with an electric motor, powered by a pack of lithium batteries, with autonomy of over 200 km.

Components. Driving sector of industrial growth

The new mobility paradigms impose to this sector and to the component one to invest in the research of green automated solutions connected with the telematics infrastructure network.

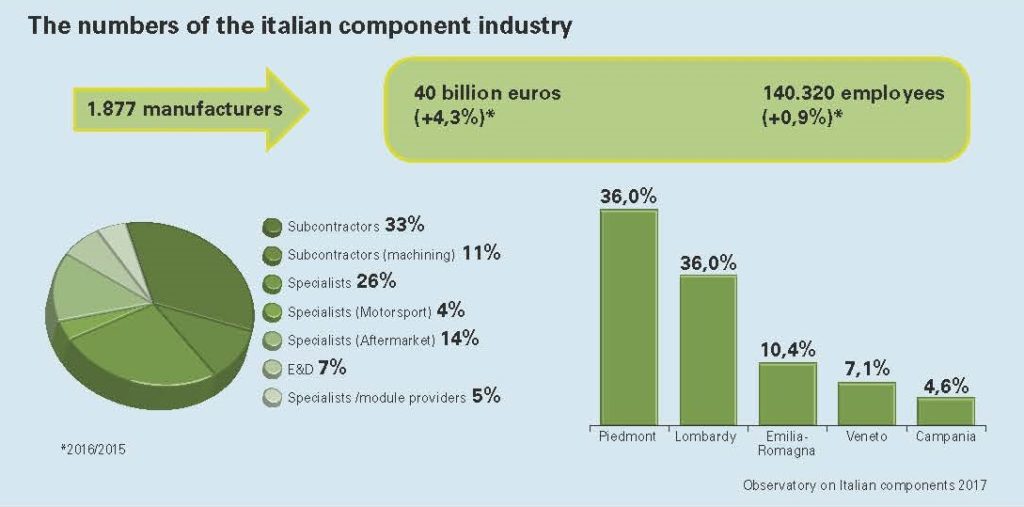

It is a dynamic and lively market, with a strong propensity for innovation. This is the picture outlined by the last edition of the Observatory on Italian components, the survey carried out by Turin Trade Chamber, by ANFIA and by CAMI Centre of Ca’ Foscari University in Venice. «In 2016, this sector achieved a turnover of 40 billion Euros, growing by 4.3% compared to the previous year.

The export is worth 20 billion Euros and the main destination areas of Italian components are Europe and United States – affirmed Vincenzo Ilotte, President of the Trade Chamber of Turin during the press conference on the Observatory –Besides, the automotive world is in constant evolution: ten years ago, we imagined a market characterized by low-cost vehicles.

Today reality is different: companies invest in the autonomous drive, in materials, in infomobility and entertainment. It is a field driven by continuous technological transformations».

The automotive industry trend in the world

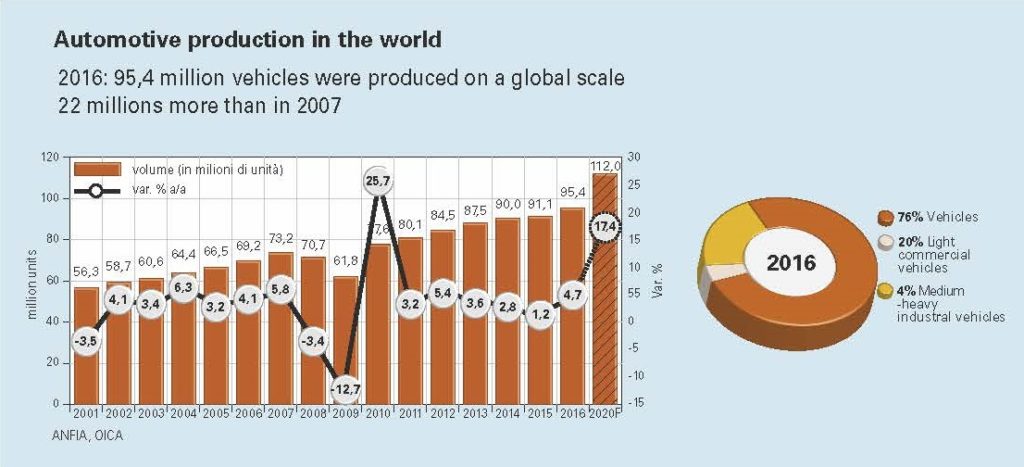

In 2016, 95 million vehicles were produced on a global scale, 22 millions more than in 2007: about half of them were sold in Asia, 23% in Europe and 19% in the NAFTA Area.

«The data on the 2017-trend show in the first semester a world-scale growth in the production of vehicles by 2.4%, amounting to 45.8 millions, with the 1.8% reduction in Europe and the 4.4% increment in Italy (576,000 units) – underlined Giuseppe Barile, President of ANFIA Component Group – In Italy, where the production of the automotive sector production grew by 7% in 2016, against the +1.7% of the overall industrial production, and the 1.1 million vehicles produced make us rank as the sixth manufacturing Country in EU. Components provide an important contribution also to the trade balance, maintaining a trade surplus for over 20 years, corresponding to 5.5 billion euros in 2016 (+0.3%) and around 3 billions in the first 2017 semester, as confirmation of the consolidated international success». The new trends that characterize the sector, such as the environmental sustainability, will exert an impact on enterprises’ working and business modalities.

«Our chain must react and achieve the suitable structure for increasing the competitiveness level through the investments in product and process innovation – added Barile – Concerning this, according to a recent survey, 46% of Italian companies have started projects connected with Industry 4.0 and 29% of them undertook all that already two years ago».

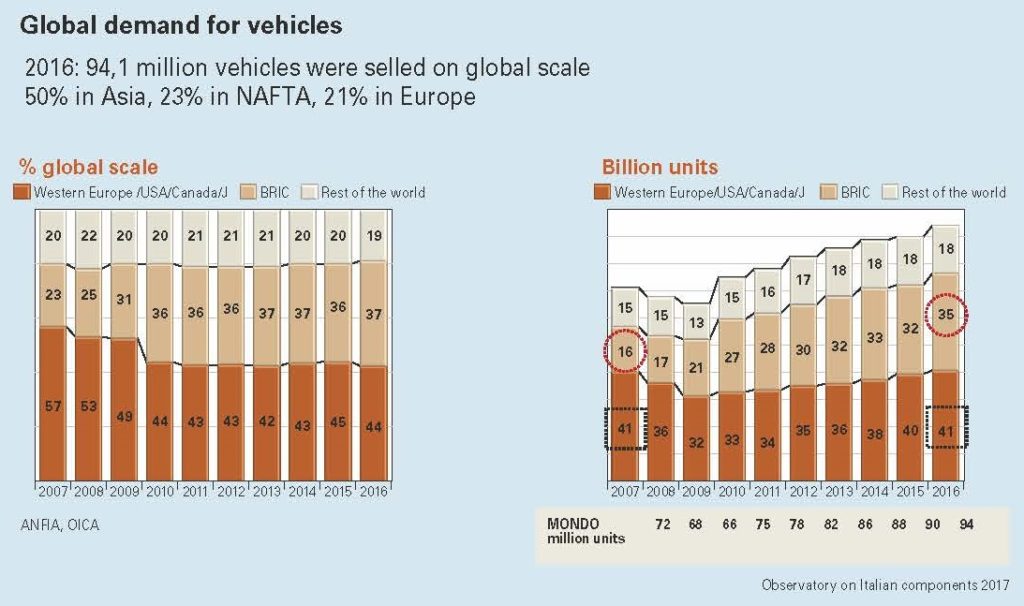

Since 2007 until now, the world demand for vehicles, risen by over 30%, has enormously changed: industrialized and “motorized” Countries, historically production areas, have witnessed the decrease of the weight of their markets from 57% to 44%, whereas BRIC (Brazil, Russia, India and China), whose demand has grown by 118% versus 2007, have reached 37% of word sales (it was 23%). In the first 2017 semester, the global demand for vehicles reached 47 million units (+2.6%). In Europe, sales rise by 4.1% also thanks to Russia, which scores +7% after years of consecutive drops. In the same year, in Italy registrations grow by 9%, whereas the year-end forecasts expect 1.98 million registrations approximately (+8%).

Since 2007 until now, the world demand for vehicles, risen by over 30%, has enormously changed: industrialized and “motorized” Countries, historically production areas, have witnessed the decrease of the weight of their markets from 57% to 44%, whereas BRIC (Brazil, Russia, India and China), whose demand has grown by 118% versus 2007, have reached 37% of word sales (it was 23%). In the first 2017 semester, the global demand for vehicles reached 47 million units (+2.6%). In Europe, sales rise by 4.1% also thanks to Russia, which scores +7% after years of consecutive drops. In the same year, in Italy registrations grow by 9%, whereas the year-end forecasts expect 1.98 million registrations approximately (+8%).

The world vehicle production, supported by the positive demand trend, in 2016 scored over 95 million units, with +4.7% versus 2015. The world productive increment was by over 4.2 million vehicles, of which 3.5 produced in China.

In Italy, both the internal demand and the export have led to over 1.1 million units produced in 2016 (+9%). Compared to 2007, the world production registers, as for registrations, the 30% rise. In the first 2017 semester, according to the estimates by Ward’s Automotive Reports, the production scores the +2.4% growth and for Italy by 4.4%. In 2017, the world production of vehicles is expected to confirm the trend, exceeding 2016 volumes. In Italy the growth is going on, too, having closed the 1st semester 2017 at +7.3 (ISTAT data). In 2016, 54% of vehicles were manufactured in Asia-Oceania, 23% in Europe and 19% in Nafta area, 4% in the rest of the world.

China is the first producer nation in the world, with 30% of the world production, followed by USA (13%) and Japan (10%).

The chain structure

The automotive component world is constantly evolving: to take the chain complexity into account, intercepting all the categories of suppliers involved, the investigation has included in its observation range also activities like specialists in telematics and infomobility, motorsport and aftermarket.

According to this logic, among automotive component enterprises, we can distinguish: system integrators and module suppliers, at the top of the supply chain with factories located closed to manufacturer’s plants, which implement functional systems or modules, with a high competence level; specialists, producers of parts and components, with such a content of innovation and specificity as to constitute a competitive edge, encompassing also the category of telematics specialists that work at applications connected with infomobility; motorsport specialists that, starting from the fitting out of cars for sports competitions, design and manufacture components (seats, steering wheels and safety belts) or supply solutions adopted for mass productions, too; aftermarket specialists, which implement parts and components directly sold on the market through a distribution network or consortia of spare part suppliers.

According to this logic, among automotive component enterprises, we can distinguish: system integrators and module suppliers, at the top of the supply chain with factories located closed to manufacturer’s plants, which implement functional systems or modules, with a high competence level; specialists, producers of parts and components, with such a content of innovation and specificity as to constitute a competitive edge, encompassing also the category of telematics specialists that work at applications connected with infomobility; motorsport specialists that, starting from the fitting out of cars for sports competitions, design and manufacture components (seats, steering wheels and safety belts) or supply solutions adopted for mass productions, too; aftermarket specialists, which implement parts and components directly sold on the market through a distribution network or consortia of spare part suppliers.

They can have supply relationships with automotive industries but there are also aftermarket divisions of the same multinationals. Besides subcontractors, which produce standard parts and components according to the specifications supplied by customers and easily repeated by competitors, and in whose category we can identify the companies that execute mechanical machining such as turning, milling, rolling, stamping or treatments (thermal, painting etc.), the chain is completed by engineering and design activities, protagonists in the devising and design of a car, particularly numerous in Piedmont (55% of the Italian total), which supply services directly to assembling companies or Tier 1 suppliers.

The Observatory’s results

The survey, presented by Barbara Barazza, Manager of the Study, Statistics and Price Sector of Turin Trade Chamber, has highlighted that in 2016 all component manufacturers scored good performances: among suppliers, the most dynamic are the specialists in motorsport (+9.5% at Italian level), subcontractors (machining) (+9.4%), E&D (+7.8%) and system/ module providers (+5.6%).

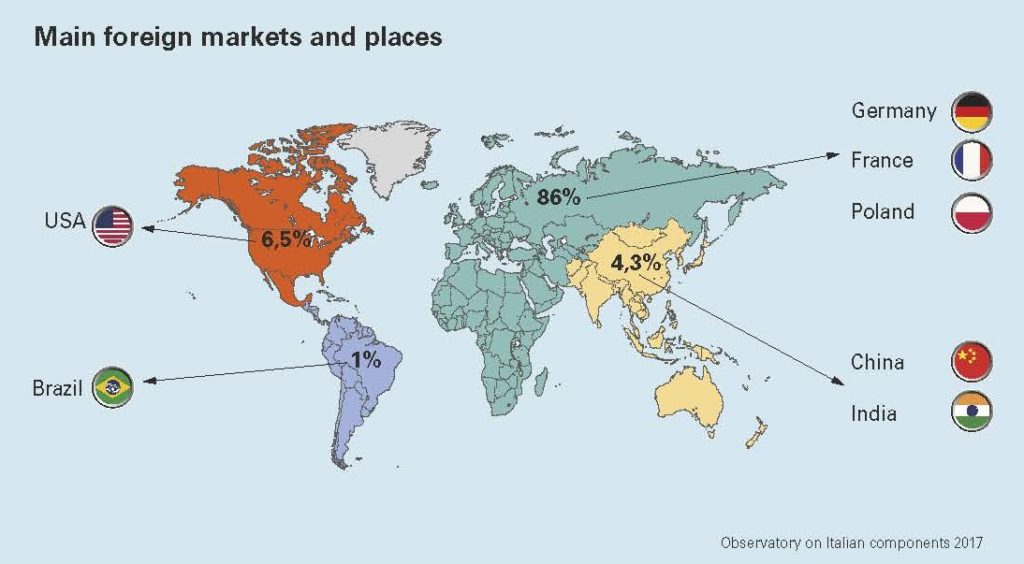

In Italy, over 76% of enterprises declare they export: the percentage has grown by one point in the last year (it was 75%). On the whole, 39% of the overall automotive turnover derives from export. EMEA (Europe, Middle East and Africa) is the main addressee of the Italian export, mentioned by 86% of enterprises but the first 5 markets are all in Europe (Germany, France, Poland, Spain and United Kingdom).

A sound component industry, thanks to export, geographical and productive diversification and enlargement of destination markets, succeeds in maintaining a high saturation level of the productive capacity, which in 2016 reached the 78% average. The percentage of enterprises that have declared a plant saturation percentage exceeding 80% has grown from 51% in 2015 to over 61% in 2016 and has indistinctively concerned all productive segments of the chain.

Sector players look optimistically at the future: for the current year, expectations not only maintain a positive sign but consolidate in comparison with the previous year: 87% of operators declare their optimism (80% in 2015) and confidence pervades all clusters, with particularly rosy forecasts for module and system providers (91% with growth estimates), specialists and E&D (89%) and the aftermarket (80%). Green, new materials, infomobility, autonomous drive, electric and hybrid motors represent the new directions in the process of transformation of automotive induced activities, like the cost reduction and the process reorganization. Finally, 71% of the sample declare they invest part of their turnover in research and development activities that are prevailingly carried out “in house”.

The round table

The last part of the press conference on the Observatory was dedicated to a discussion, chaired by Francesco Zirpoli, Center for Automotive and Mobility Innovation, Ca’ Foscari University, on the opportunities and the challenges for the Italian component chain.

«The Italian automotive supply chain is living a time of growth and development. However, the mobility world is changing. The Italian component industry will be able to constitute the backbone on which to base the mobility future in Italy if it succeeds in reversing the trend involving lower investments than international competitors in research and development and scarce networking to gain access to new technological competences.

As far as the overall Italian situation is concerned, the challenge to be won is maintaining in Italy the design and the production of vehicles, systems and modules with high technological complexity. This requires a trend inversion in innovation investments that currently position Italy in a disadvantaged situation compared to Countries with a similar industrial tradition». Massimo Mucchetti, President of Senate Industry, Trade and Tourism Commission highlighted that in Italy, in industrial ambit, components are becoming more and more important than the implementation of the finished product but it is necessary to invest to be in the technological forefront.

As far as the overall Italian situation is concerned, the challenge to be won is maintaining in Italy the design and the production of vehicles, systems and modules with high technological complexity. This requires a trend inversion in innovation investments that currently position Italy in a disadvantaged situation compared to Countries with a similar industrial tradition». Massimo Mucchetti, President of Senate Industry, Trade and Tourism Commission highlighted that in Italy, in industrial ambit, components are becoming more and more important than the implementation of the finished product but it is necessary to invest to be in the technological forefront.

Giorgio Elefante, Automotive Sector Leader Italy Price Waterhouse Coopers was then called upon to speak: «There are some key points for the business management: the awareness of challenges, the conscious determination of strategies, the individual and collective professional force and institutions’ support. We need clear rules supporting innovation. The automotive sector is driven by some big changes that will exert an impact on mobility, such as demographic trends and urbanization, the geo-political scenario characterized by a rising climate of protectionism, climatic changes and the shortage of resources, the technological evolution of products and services. Finally, internationalization plays a determinant role and it is necessary to support those enterprises that invest in research and development centres so that they can create sustainable value».

Vincenzo Ilotte, General Manager 2A Spa highlighted the great flexibility of the net in our entrepreneurial fabric and how this element can represent a point of attraction. In the opinion of Giuseppe Barile it is necessary to focus on research and development. Ezio Fossati, ZF Senior Vice President FCA & CNH Global Sales Division A has reconfirmed that it is essential to create an eco-system of collaborations: «Technologies evolve so quickly that no company can have all competences in its inside» (Elena Ferrero).

UE, mandatory labelling for electric charge sockets

Since March 20th 2021, in the European Union it has come into force the obligation of applying the labels conforming to the standard defined in the EN 17186:2019 regulation on new electric vehicles that can be charged by grid and by all charge stations.

This to comply with the art. 7 of DAFI Directive for the typologies of vehicles concerned by the regulation: mopeds, motorcycles, tricycles and quadricycles, cars, light and heavy commercial vehicles and buses.

On vehicles, labels will be applied close to the fixed connector of the vehicle and on the mobile connector for the recharge (also in case of removable charge cables), as well as in the use and maintenance manual.

In the most recent models, they will be also placed in the electronic manual included in the vehicle’s infotainment system.

Concerning charge stations, labels will be put either next to the current socket or in the compartment housing the connector for the vehicle charge. Labels will be present, for information, also at vehicle dealers’.

The application of labels is in force in all 27 member States of the EU, in the Countries of the European Economic Area (Iceland, Lichtenstein, Norway), but also in Serbia, Macedonia, Switzerland and Turkey.

Labels will be put also on the new vehicles produced in EU and intended for the British market, irrespective of this Country’s decisions about the application of EU regulations after Brexit.

Playing with electric motors

Powerup 4.0 electric small-size motor can be adapted to whatever model aircraft made of paper, balsa or other materials, to provide a thruster can transform a child’s game into a didactic flight experience.

The latest version is equipped with electronic stability control, a minicomputer for the flight attitude control, a gyroscope, two independent motors with differentiated thrust, electric motor, acrobatic performances, assisted take-off and landing. The thrust generated by this propulsion plant can make the model aircraft fly at a maximum speedof 36 km/h, with eventual aerodynamic “imperfections” that will be rebalanced and corrected.

The latest version is equipped with electronic stability control, a minicomputer for the flight attitude control, a gyroscope, two independent motors with differentiated thrust, electric motor, acrobatic performances, assisted take-off and landing. The thrust generated by this propulsion plant can make the model aircraft fly at a maximum speedof 36 km/h, with eventual aerodynamic “imperfections” that will be rebalanced and corrected.

Another phenomenon in the model world belongs to the electric pickup of Tesla Cybertruck, with Hot Wheels brand. The radio-controlled model launched at the end of 2020 was impressively sold-out in very short time and Mattel has started the reorder for a supply expected to restart next May. Customers are offered two sizes of the radio-controlled Tesla Cybetruck: one in 1:64 scale and the other, the most coveted, almost 60-centimetre long, can comfort- ably move on whatever ground, turn on front and rear lights and offer two drive modalities tranquil “chill” and “sport”.

Another phenomenon in the model world belongs to the electric pickup of Tesla Cybertruck, with Hot Wheels brand. The radio-controlled model launched at the end of 2020 was impressively sold-out in very short time and Mattel has started the reorder for a supply expected to restart next May. Customers are offered two sizes of the radio-controlled Tesla Cybetruck: one in 1:64 scale and the other, the most coveted, almost 60-centimetre long, can comfort- ably move on whatever ground, turn on front and rear lights and offer two drive modalities tranquil “chill” and “sport”.

The rear can slide turn into a ramp and the body- work can be removed to enter interiors with battery and transmission.

The “Swiss Army Knife” of power electronics

Among the top players for the electric propulsion, ranks BAE Systems, which will bring its next-generation power and propulsion technology to the heavy-duty industrial vehicle market. The company’s electric drive system provides a revolutionary design which will help industrial vehicle original equipment manufacturers (OEMs) get their electric vehicles (EVs) to market faster and at a lower installed cost.

Steve Trichka, vice president and general manager of Power and Propulsion Solutions at BAE Systems said: «We are providing an all-inclusive solution to bring the industrial vehicle market one step closer to a zero-emission future. Our next-generation components are the Swiss Army Knife of power electronics, delivering multifunctional capabilities in a compact and flexible design. This flexibility makes it easier for OEMs to cover multiple platforms, including traditional diesel and purpose built EVs».

BAE Systems’ next-generation system for the heavy-duty industrial vehicle market builds on the company’s more than 25 years of experience in low and zero emission EV solutions for the transit bus and marine industries. The system uses fewer components and increases electrical efficiency. Its Modular Accessory Power System (MAPS) and Modular Power Control System (MPCS) also allow for scalable, customized solutions to provide the core power for a range of applications, from school buses and mining vehicles to sanitation and yard trucks.

BAE Systems has a deep understanding of systems engineering, a revolutionary design for propulsion and accessory power, proven integration expertise, and aftermarket support to give manufacturers a reliable solution and faster path to market, at a lower installation cost.

Mega-factory of electric scooters according to Industry 4.0 principles

Ola, one of the leader mobility companies in the world, has selected ABB as one of its key partners for robotics and automation solutions for its mega-factory in India, which will release its so longed- for electric scooter.

The structure, expected to be ready and operational next months, is likely to be the largest factory of scooters in the world. In the main process lines, ABB automation solutions and ABB robots will be used, exploited also for the assembling lines of batteries and motors.

They will be digitally integrated into the factory enabled by the artificial intelligence, to optimize performances, the productivity and the quality of robot product.

The exploitation of ABB robots and automation solutions will assure the remote digital connectivity and the monitoring of robots that will use the artificial intelligence motor and the technological stack owned by Ola.

With an initial yearly capacity of 2 million units, the mega factory of Ola will create 10,000 workplaces and will act as global production hub of the company for both India and for the international markets in Europe, United Kingdom, Latin America, Australia and New Zealand. It is foreseen the mega-factory will be the most automated in the Country, with about 5,000 robots and autonomous-guided vehicles in use once the factory will be completely operational at its full capacity.

Byd is coming in Europe

The Chinese giant is about to land in Europe with its SUV Tang EV600. The debut of BYD in the Old Continent, in the segment of passenger cars, after making itself renowned with buses and professional vehicles, will take place in Norway, the motherland of electric mobility, through RSA distributor, which will take care of sales, after sales service and spare parts.

The car is a sport utility with permanent four-wheel drive that offers an autonomy of 520 km thanks to lithium batteries, and provides 5 or 7 seats for almost 5-metre length.

Isbrand Ho, managing director of BYD Europe, stated the Norwegian market is the natural choice to start this expansion process but, in the long term, the goal is expanding the sales of electric cars also in the rest of Europe.

The new silent roar of Harley Davidson

It made its début last July 18th and since 2022 it will be available on international markets. We are speaking of the new electrified Harley Davidson, LiveWire One, and proposed without the mythical logo from the iconic United States company. Therefore, it will have a dedicated EV brand, to underline that the electric range is a fully different story.

However, let us take a step back: the first electric HD, LiveWire, was conceived for the urban environment and was presented 3 years ago: the motor features 78 kW of power and has a maximum autonomy of 235 km, actually the same characteristics as LiveWire One.

The electric motorcycles is always connected to transmit road indications, to monitor the warnings and the recharge status. The bike recharges in DC Fast Charge from 0 to 100% in 60 minutes and from 0 to 80% in 45 minutes, with advanced software and hardware.

Transport & Environment: 80% of electric motors by 9 years

The European Federation for transports and environment, commonly indicated as Transport & Environment, has recently ordered Governments to anticipate the provision for decreasing emissions that would ban all forms of non-electric motors. The context was COP26 climate one, followed by a diktat coming from the group of sustainable mobility lobbyists: «The car industry’s electrification – said Julia Poliscanova, senior director for vehicles and e-mobility at T&E – plans place it ahead of regulators on climate action. But these won’t materialise without actual targets to end car emissions by 2035 at the latest. The US and Europe, especially Germany and France, need to lead».

The next step advocated by Transport & Environment is closer: the automotive industry must cut emissions by 80% within 2030.