Last March 30th closed the experience for Formula SAE Italy (FSAE Italy) at MECSPE (Fiere di Parma, 28-30/03), the meeting point between technologies to produce and industrial supply chains, thanks to the sinergy among the 12 fairs which happen at the same time.

The three days in Parma represented an important halfway point on the way to the official event scheduled on July from 24th to 28th at “Riccardo Paletti” racetrack in Varano de’ Melegari, when Formula SAE Italy (www.formula-ata.it/) will welcome 100 universities teams from all over the world (33 with an electric car, 52 with a combustion car, 10 with a driverless car and 5 for class 3, with the project only, without car) which challenge each others in the designing and in the realization of a racing prototype.

The ANFIA-Formula SAE stand during the exhibition hosted three FSAE Italian teams and their cars: UniPR Racing Team of the University of Parma with their combustion car, Squadra Corse PoliTo of the Polytechnic University of Torino with their electric car, both of them will be part of the official event in July – and MoRe Modena Racing team of the University Modena e Reggio Emilia with their combustion car.

The ANFIA-Formula SAE stand also included a space dedicated to Dallara – one of the historical sponsors of the event together with FCA – which hosted a FIA Formula 2 (F2) car and organized few conferences in the neighboring workshop area.

“The participation of FSAE Italy at MECSPE gave to the teams the chance to get in contact with some potential sponsors, to explain to the innovation technologies used to build the cars and it gave to ANFIA the chance to let the exhibition learn about this event which stands out the designing abilities but also the management and the team working of the young automotive engineering – says Gianmarco Giorda, Director of ANFIA. MECSPE experience contributes to put in contact two world which are still pretty distance but connected, like the University’s world and the companies one”.

ANFIA, three FSAE Italian teams and their cars

E-mobility, the electric-vehicle disruption is inevitable

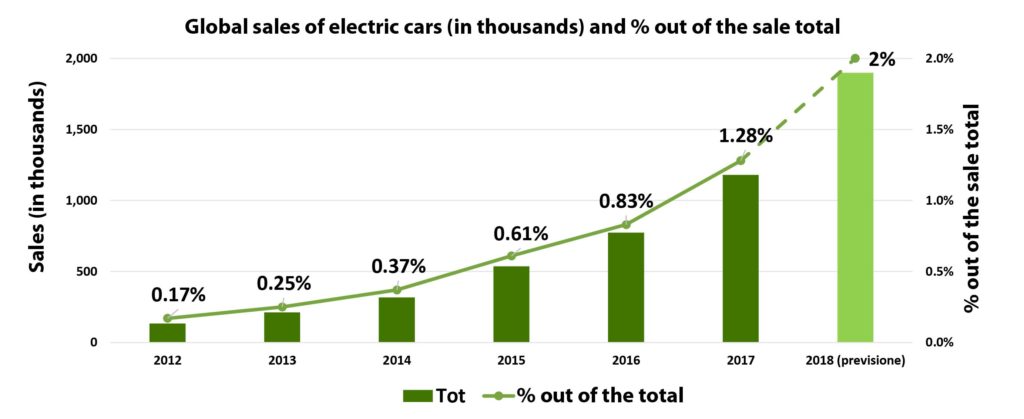

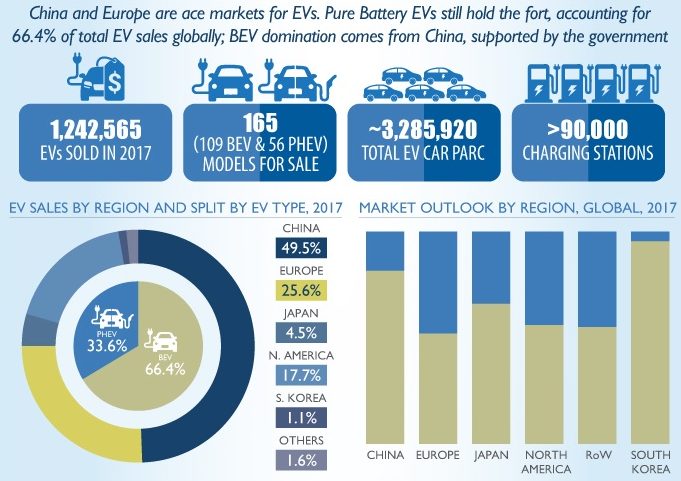

Almost 1.2 million electric cars sold in the world in 2017, the most positive result ever obtained, and it is expected that such trend will be confirmed for 2018 with 2 million new electric cars on the market. In Italy, the technological maturity is the reference indicator that shows fewer criticalities, on the contrary the regulatory maturity is the area with more gaps.

The E-mobility Report 2018, developed by the Energy & Strategy Group of Milan Polytechnics, managed by Professor Vittorio Chiesa, has highlighted the state of the art of the electric vehicle market in Italy, Europe and in the rest of the world.

The world situation

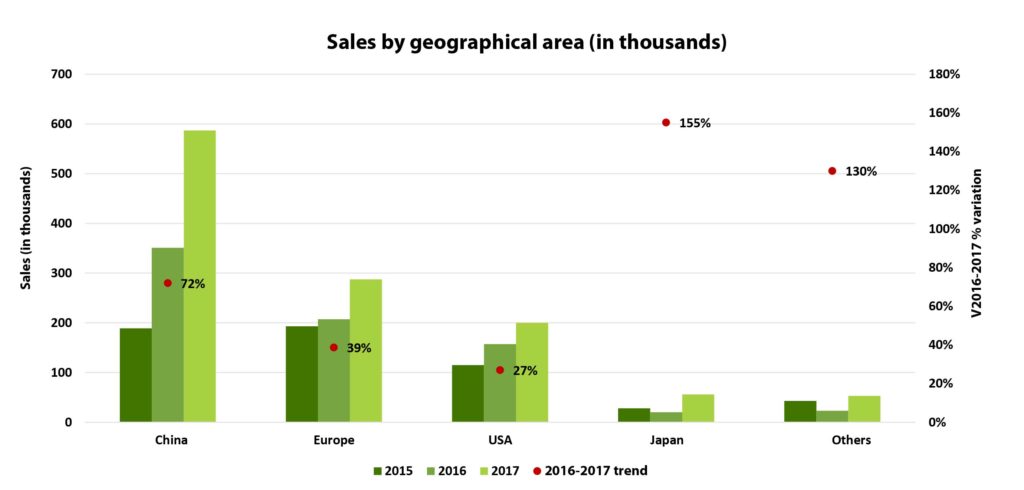

In 2017, almost 1.2 million electric cars were sold in the world, over 1% of the total of new registrations and 57% more compared to the 750,000 units in 2016. It is the most positive result ever achieved and it is expected that such trend will be confirmed for 2018 with 2 million new electric cars on the market. With around 580,000 cars sold in 2017 and a 72% growth versus the previous year, China is the biggest world market, overcoming Europe that confirms to be second in the ranking with almost 290,000 sold units and scoring the 39% increment. United States follow with 200,000 (+27%) and Japan is at the fourth place with 56,000 cars and a noteworthy +155% compared to 2016.

The e-mobility in Italy – specified Vittorio Chiesa – is not a market where the growth is missing. Absolute numbers are still small in comparison with other big European Countries but the sensation we can perceive among sector players is that the electric mobility is anything but an elitist fashion for lovers of sustainability and technology but it is instead becoming a fundamental component of the way of devising the transports of the future

In Europe

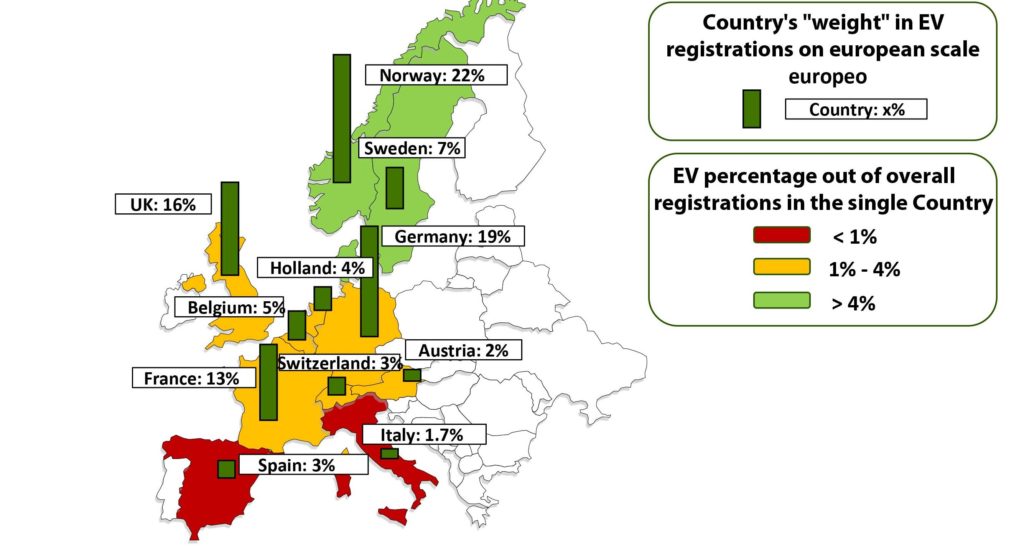

In European ambit, the first market is – indisputably – Norway, with 62,000 vehicles sold, that is to say the third Country by registrations after China and United States, but with a significant 39% out of the overall car sales inside the Country. Germany conquers the second position in the European market, with almost 55,000 registrations, over the double than in 2016 (+117%), also due to the direct incentive to purchase (4,000 Euros for a BEV, 3,000 Euros for a PHEV) and the exemption from the payment of the road tax for 10 years since the purchase time. Germans have surpassed the United Kingdom, which stopped at about 47,000 and +27%, third Country in Europe by registrations of electric vehicles (13% of the total) that offers a direct incentive amounting to 35% of the purchase cost, for a maximum of 5,100 Euros for a BEV and around 2,800 Euros for a PHEV, in addition to a reduction of yearly taxes. France follows with 37,000 and +26% and it directly incentives the purchase of an electric vehicle up to a maximum of 6,000 Euros, with a further incentive of 4,000 Euros for a BEV and 2,500 Euros for a PHEV if as replacement of a diesel vehicle with over 11 years of service life. These first four Countries attain 70% of the total in Europe.

In 2017, for the first time it was exceeded one million of cars sold on a world scale, over 1% of overall new registrations. We expect that such positive trend is confirmed for 2018, at the end of which 2 million new electric cars are likely to be present on the market

With around 580,000 cars sold in 2017 and a 72% growth versus the previous year, China is the biggest world market, overcoming Europe that confirms to be second in the ranking with almost 290,000 sold units and scoring the 39% increment

«In this ranking – explained Professor Vittorio Chiesa, director of the Energy Strategy Group of the Polytechnics – even if it has shown strong growth signs in 2017 and in 2018, Italy is still very behind and in 2017 it weighed by less than 2% in the European market of electric vehicles, against 13% of total registrations. The main hindrances connected with the take-off of the electric vehicle market are the high purchase cost of cars, the problems concerning the inadequacy of the recharge network and the limited autonomy».

In Italy

Italy is the third nation in Europe, preceded by Luxembourg and Malta, by number of per head vehicles. They have surveyed that there are over 7 vehicles every 10 inhabitants, one more than in France, Germany and UK, where this ratio is included between 5.8 and 5.9. Besides, the average age of a car of the fleet circulating in Italy is higher, with 10.7 years against 9 of France and Germany and 8.5 of the United Kingdom. In the light of these data, we can foresee a renewal that should lead to a significant adoption of electric vehicles. All that induces to think that in 2030 in Italy we might have 7.5 million circulating electric vehicles and a volume of investments amounting to 61 billion Euros.

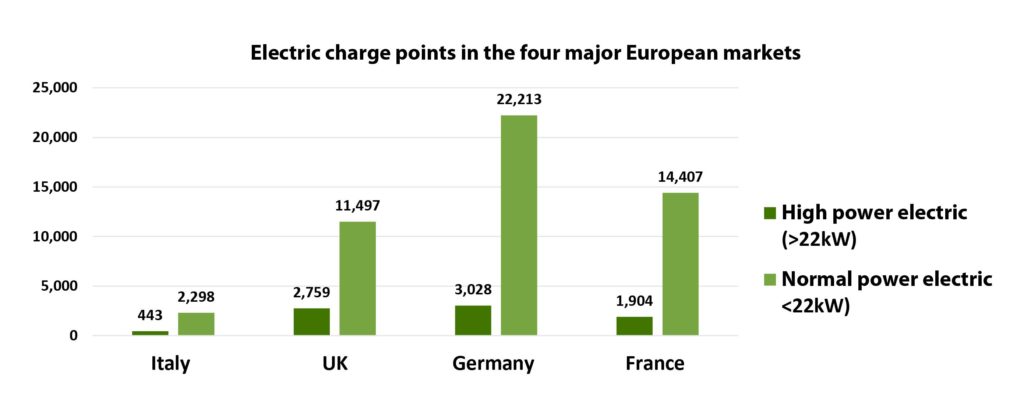

If we make a comparison between the recharge infrastructures in Italy and the rest of the Old Continent, the existing gap is evident, with a number of public charge points included betwween 10% and 20% compared to the 3 major European Countries

Let us see anyway the data already registered: in the first semester of 2018, almost as many electric cars as in the entire previous year were registered, and the same “doubling” was scored between 2017 and 2016. However, the Italian market’s size is small if compared with the global and the European market. In 2017, 4,827 electric cars were sold, 0.24% of overall registrations, thus achieving an approximate total of 13,000 units circulating in Italy at the end of the last year.

Out of 4,827 electric cars, 1,964 are full-electric, rising by almost 40% versus 2016. The remaining 2,863 are instead PHEV, 2.5 times compared to the registrations in 2016, surpassing BEV for the first time. In the first half of 2018, 4,129 electric cars were registered, +89% versus the same 2017 period and a number that approaches the entire year just past.

In European ambit, the first market is indisputably Norway, with 62,000 vehicles sold, Germany ranks second, with almost 55,000 registrations, followed by United Kingdom and France

«The e-mobility in Italy – specified Vittorio Chiesa – is not a market where the growth is missing. Certainly, absolute numbers are still small, slightly above the 4,000 vehicles in the last semester and also in relation to what is happening in the other big European Countries. The sensation we can perceive among sector players, however, is that the electric mobility is anything but an elitist fashion for lovers of sustainability and technology but it is instead becoming a fundamental component of the way of devising the transports of the future».

In the market of electric cars in Italy, the technological maturity is the reference indicator that shows fewer criticalities, the regulatory maturity is instead the area with more gaps. Incentives, if well proportioned, can act as enhancing instrument of the market competition whereas today in Italy they just regard the exemption of the road tax and the access to restricted traffic areas, with purchase incentives delivered on a regional scale only.

Infrastructures

At the end of 2017, in Italy it is possible to estimate about 2,750 public compliant recharge stations, grown in the course of the last year by around 750 units. This has resulted in the growth of the last years, drastically reversing a trend that instead had made the recharge units essentially stable from 2012 to 2014.

Moreover, it is worth pointing out a great ferment regarding new installations in the course of 2018, with partial data that indicate an even stronger growth than last year.

In Italy, in 2017, 4,827 electric cars were sold, 0.24% of overall registrations, thus achieving slightly less than 13,000 units in all circulating in Italy at the end of the last year

It is worth underlining a strong unbalance of the geographical distribution of recharge units: there is a relevant shortage in the South whereas Centre and North are more advanced but with even remarkable differences among the various Regions.

If we make a comparison between the recharge infrastructures in Italy and the rest of the Old Continent, the existing gap is evident, with a number of public charge points included between 10% and 20% compared to the 3 major European Countries: a litmus paper of the size of the electric vehicle market.

Advanced mobility services

ZF has established Car eWallet GmbH, a start-up headquartered in Berlin that will be entrusted by the Germany company with Car eWallet service activities, permitting to pay for the refuelling, for recharging electric cars or also for tolls, parking and car sharing. The project involved then the temporary collaboration between ZF and IBM and UBS partners, positively ending last Spring. Now, the target is further developing and marketing the service: in an initial financial phase, ZF will give the start-up the starting capital; in the future, investors will have to grant funds. «In this way – explained Alexander Graf from ZF Friedrichshafen AG, one of the first creators of Car eWallet and today project manager – we can exploit the dynamism of the scenarios where start-ups operate, where several innovative approaches can be developed more freely and quickly compared to what happens in a corporate structure».

DC Motors: the global value for 2020 is espected to be 130 billion dollars

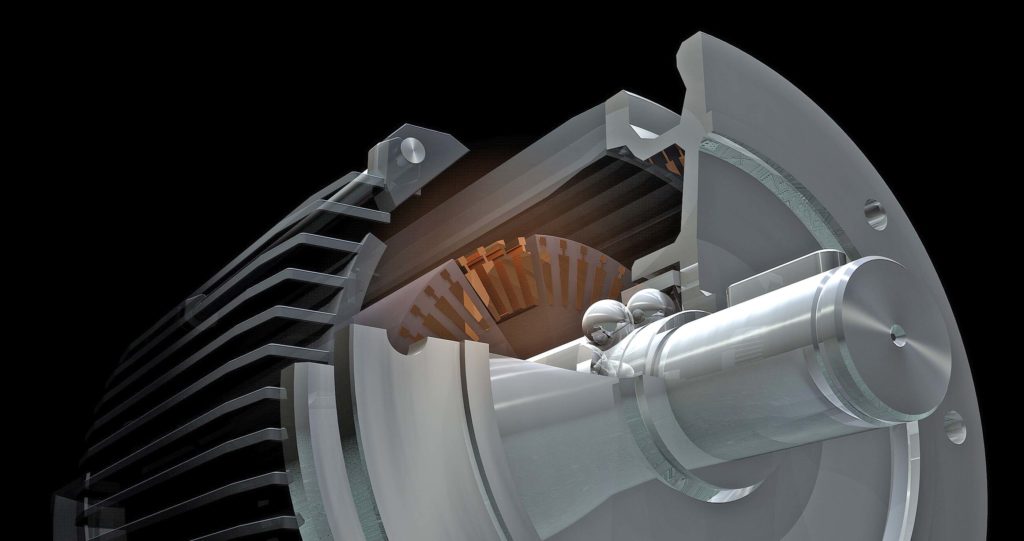

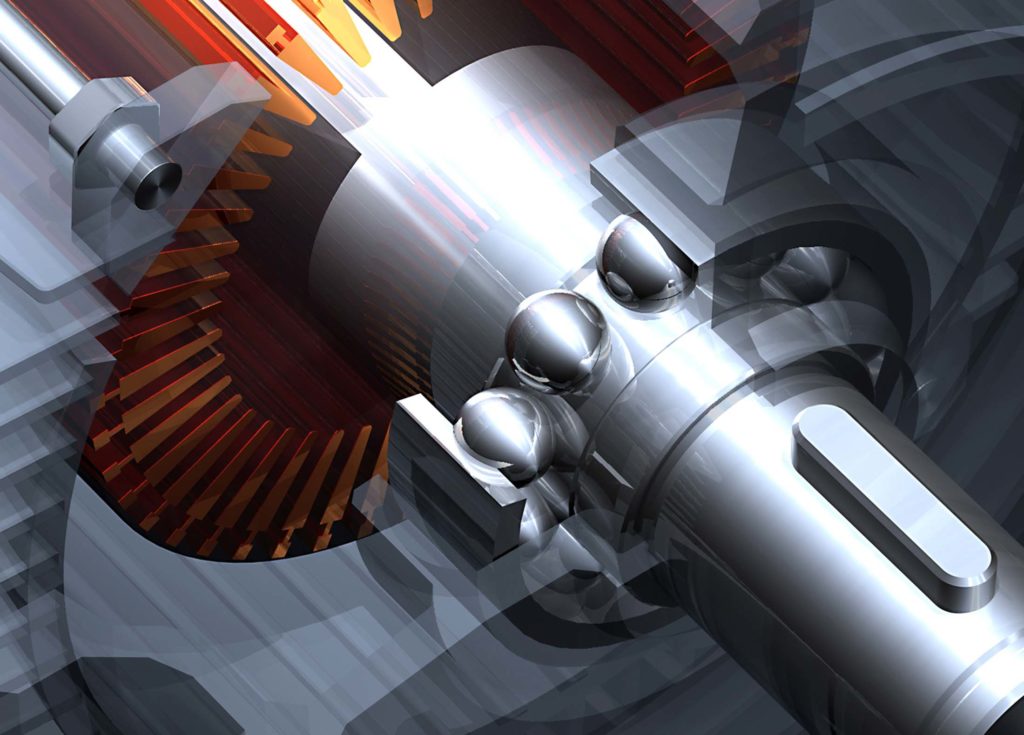

An electric motor, highly simplifying, converts electric energy into mechanical energy and this occurs through two interacting magnetic fields, one stationary and the other integral with a moving part. The origins of electric motors date back to a distant past, if we remember the base principles of electromagnetic induction were discovered in the early years of 1800 by Oersted, Gauss and Faraday, in 1820 Oersted and Ampere demonstrated that an electric current produces a magnetic field and, according to the historiography on the matter, the first real rotary engine was created in 1834 by Moritz von Jacobi. Today electric motors are a technologically advanced reality, available in manifold typologies, with a global market value that for 2020 is expected to approach 130 billion dollars,

then almost 110 billion Euros at the current exchange rate. Considering a basic subdivision, they are split into AC motors and DC motors, and both these categories provide then for other detail subdivisions. AC motors, for instance, are developed into synchronous, asynchronous or induction, single-phase or three-phase. In the first case, the rotor rotation is synchronized with the frequency of the power supply current and the speed remains constant if the load varies; ideal for moving a load at constant speed, they are used for high-precision positioning.

In the second typology, the electromagnetic induction from the magnetic field of stator windings is used to produce an electric current in the rotor, and then torque; single-phase motors are generally adopted for small loads whereas three-phase ones have their use context in industrial ambit, for instance for compressors, pumps, conveyors and lifting systems. DC motors, the first broadly used also due to the user-friendly speed control by varying the power supply voltage, provide for two main branches: Brushed, or Brush, with brushes, and Brushless, without brushes. Traditionally, the subdivision is done by power: 0-750 Watt (with the major market share), 750 Watt-3kW, 3kW-75kW, and above 75kW. Concerning the global size of this market, the data that can be inferred from some of the most in-depth researches on DC motors are quite differing, especially if projections are on the long-term; they report for instance 35 billion dollars within 2025 (reference: Grand View Research, Inc), and highlight that the growth of the DC motor market will be mainly driven by the Automotive ambit. The sales of Brushless motors are prevailing in comparison with Brushed, and already in 2016 they held the highest market share. Still according to projections, they indicate for Brushed a growth with CAGR (Compounded Average Growth Rate) by around 3% from now until 2025, which becomes by 4% for Brushless.

DC Brushed motors

Following an approach of scholastic type, a typical DC brushed motor includes a rotary armor, or rotor, which contains windings of wires insulated and wound around a weak iron core, and a stationary stator that encloses the rotor and contains electromagnets or permanent magnets that generate the magnetic field. The windings, which form one or more coils, are electrically connected with the commutator, a cylinder consisting of various metal contact segments around the armor bar. Brushes are electric contacts made with soft material, typically graphite, in contact with the segments of the commutator when the bar rotates. If we apply a DC power source to brushes, the coils of the armor are energized, creating an electromagnet that is set in rotation, with its north and south poles aligned with stator ones; with the rotation, it is determined an inversion of the energy polarity in the armor coils and of the direction of the relative magnetic field; the armor rotates towards the new alignment, the current is inverted again and the armor goes on rotating. This inversion is commonly identified by the term of “mechanical switchover”. Acting on the arrangement of windings, different typologies of DC Brushed motors have been implemented. In a motor with winding in derivation, where field coils of stator and rotor are connected in parallel, the operation is at constant speed, irrespective of the load. In the case of winding in series (two coils wound in series), the speed varies with the load and it increases when the latter decreases, but making high start torque available.

The characteristics of both previous typologies are achieved with a composite winding, combination of the motors with winding in derivation and in series, typically used when complex start conditions occur and when a constant speed is required. Separate excitation motors, with separate feeders for stator and rotor, hence with high field current for the stator and sufficient voltage for the armor to produce the necessary torque current for the rotor, find application when low speeds but high torque capacities are needed. A further typology is with permanent magnets in the stator, thus annulling the need of an external field current: the design is more compact and lighter and the energy efficiency is higher in comparison with other DC Brushed. The control of a DC brushed motor is essentially simple because the switchover is mechanically executed. In a constant-speed motor, for instance, just a DC voltage and an on/off switch are necessary while the speed can be modified by varying the voltage. If a more sophisticated control is needed, specific circuits, widely available and well consolidated, are adopted while a PWM (Pulse-Width Modulation) signal is used for the speed control: the motor winding operates as low-pass filter, so that high-frequency PWM waveforms generate a stable current in the motor winding. For more precise regulations, it is possible to integrate a speed sensor, for instance a Hall-effect sensor or an optical encoder, thus creating a closed loop. In short, DC Brushed motors are inexpensive, reliable and with a high torque/inertia ratio but they have the problem of brushes that tend to wear in time, hence the need of periodical maintenance, for replacement or cleaning. Worth considering other limits, too: if the motor has big power, other problems of heat disposal arouse because windings heat up by Joule effect; windings make the rotor heavier, from which the rise of the moment of inertia derives; besides, if the motor must provide a fast and precise response, as required in industrial automation and in robotics, the control becomes more complex; electromagnetic interferences are generated in the arc of brushes because between them and the collector, in switchover times, there are opening transients of inductive windings and then flashing, which can be anyway attenuated by various devices. (A.C.)

Another piece of the GROB puzzle

The development of GROB is unstoppable. The German company continues to expand itself in Italy too, in order to complete its European presence and focus increasingly on the production of electric motors.

Top player in the design and construction of high-efficiency machining centres and production lines, the family-run company GROB – now in its third generation – is investing resources in the Italian territory, and last 12th march it has inaugurated the construction of a new plant in Pianezza, close to Turin. We were present at the ceremony for laying the foundation stone. The inauguration of the construction took place in the presence of the German management board of GROB, Christian Grob and German Wankmiller, the CEOs of GROB Italy, Mauro Marzolla and Marco Debilio, the mayor of the municipality of Pianezza and the main exponents of the local industrial fabric.

The company

Let’s take a step back. In 2017, the machine tool manufacturer GROB acquired DMG meccanica, an Italian manufacturer of machines for the production of stators for alternators and electric motors. This strategy underlines the willingness of the German player to focus more on the e-mobility sector and to establish itself as a manufacturer of electric motor components.

Today GROB has a total of 6,900 employees and a turnover of 1.5 billion euros, fifteen branches around the world, five production plants in Germany, the United States, China, Brazil and Italy, in Buttigliera Alta (current headquarters of the former DMG meccanica).

“With this establishment” – Christian Grob said, – “we add another piece to our puzzle. We want to strengthen our presence in the electric vehicle sector, engaging even more in research and development of technologies for the electromobility sector. We are also investing in this new Turin headquarters with the aim of bringing together the entire production circuit, from the idea to the realization.”

The factory

Today, the plant located in Buttigliera Alta is no longer able to cope with the higher productivity required by the development of the business, increasingly projected to automatic lines for the production of electric motors. The new Pianezza site will be ready in about 14 months, starting at full capacity in the summer of next year.

“The transfer of the GROB Italy plant from Buttigliera Alta to Pianezza,” – explained Margherita Marzolla, – “is part of a multi-year development plan, intending to make Pianezza a reference point in the design and construction of special machines and automation solutions aimed at creating electric motors.”

The new plant in Pianezza will be a highly functional centre, distributed on a total area of 24,000 m² of whit 4,800 m² of production area and 3,300 m² of offices and services. The goal is to understand the entire production circuit, from conception of the idea to its practical construction, and the economic investment allocated to date is about ten million euros.

This is good news for local employment: the current GROB Italy workforce includes about 60 employees, but an increase of around 40-50 new jobs is expected in the first phase. Internal training courses will therefore be activated, which, in collaboration with a vast network of local excellence in education, will provide young people with a specific technical preparation.

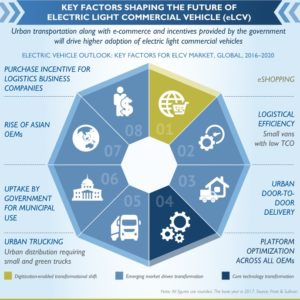

Components. Driving sector of industrial growth

The new mobility paradigms impose to this sector and to the component one to invest in the research of green automated solutions connected with the telematics infrastructure network.

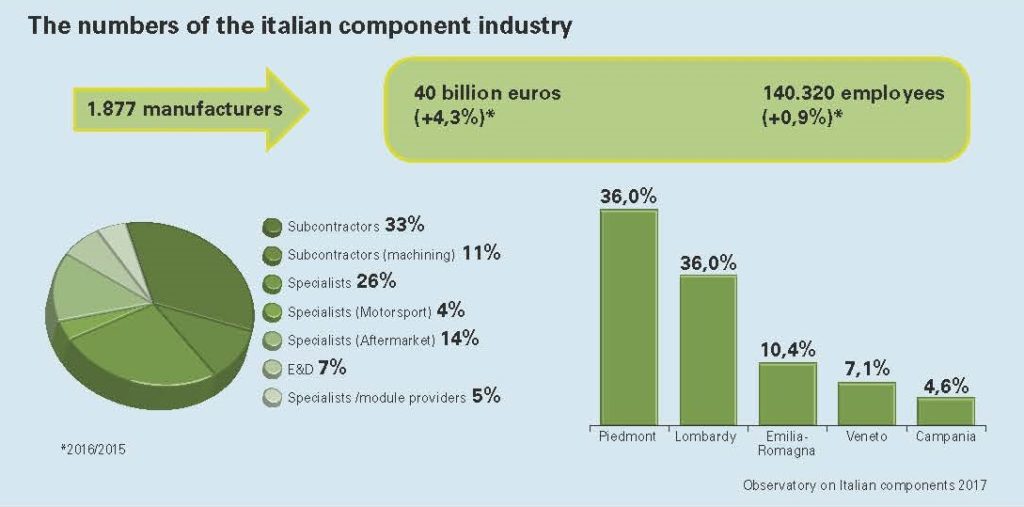

It is a dynamic and lively market, with a strong propensity for innovation. This is the picture outlined by the last edition of the Observatory on Italian components, the survey carried out by Turin Trade Chamber, by ANFIA and by CAMI Centre of Ca’ Foscari University in Venice. «In 2016, this sector achieved a turnover of 40 billion Euros, growing by 4.3% compared to the previous year.

The export is worth 20 billion Euros and the main destination areas of Italian components are Europe and United States – affirmed Vincenzo Ilotte, President of the Trade Chamber of Turin during the press conference on the Observatory –Besides, the automotive world is in constant evolution: ten years ago, we imagined a market characterized by low-cost vehicles.

Today reality is different: companies invest in the autonomous drive, in materials, in infomobility and entertainment. It is a field driven by continuous technological transformations».

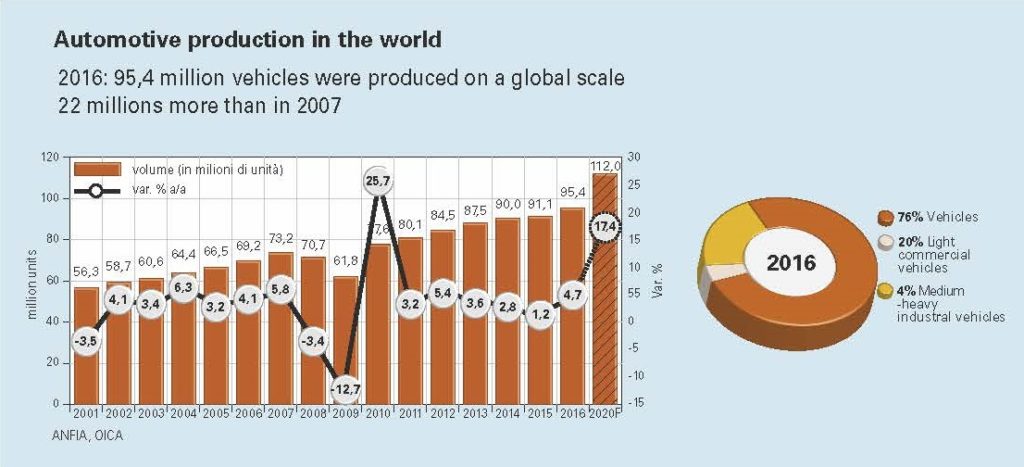

The automotive industry trend in the world

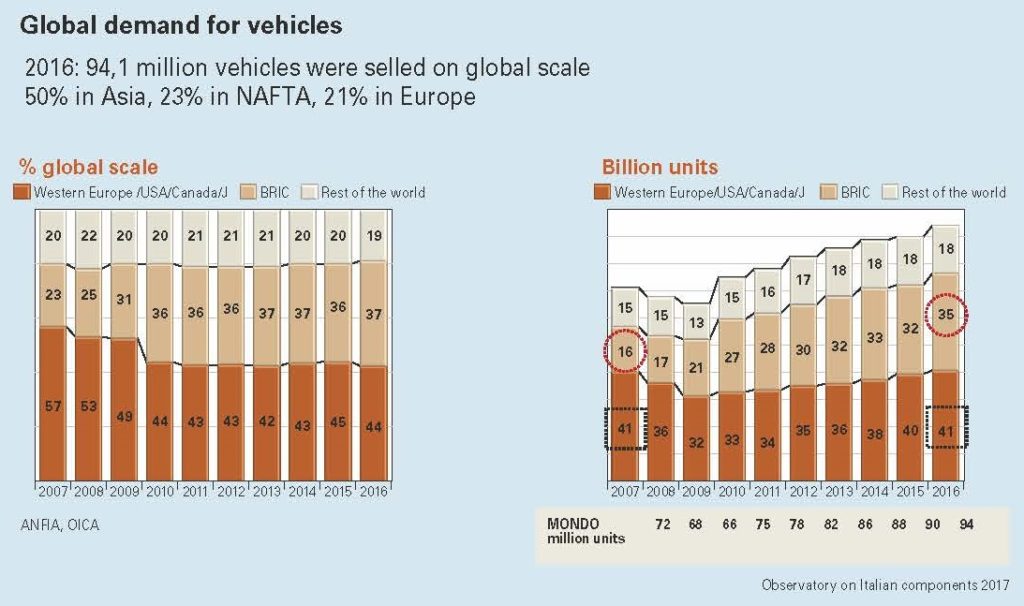

In 2016, 95 million vehicles were produced on a global scale, 22 millions more than in 2007: about half of them were sold in Asia, 23% in Europe and 19% in the NAFTA Area.

«The data on the 2017-trend show in the first semester a world-scale growth in the production of vehicles by 2.4%, amounting to 45.8 millions, with the 1.8% reduction in Europe and the 4.4% increment in Italy (576,000 units) – underlined Giuseppe Barile, President of ANFIA Component Group – In Italy, where the production of the automotive sector production grew by 7% in 2016, against the +1.7% of the overall industrial production, and the 1.1 million vehicles produced make us rank as the sixth manufacturing Country in EU. Components provide an important contribution also to the trade balance, maintaining a trade surplus for over 20 years, corresponding to 5.5 billion euros in 2016 (+0.3%) and around 3 billions in the first 2017 semester, as confirmation of the consolidated international success». The new trends that characterize the sector, such as the environmental sustainability, will exert an impact on enterprises’ working and business modalities.

«Our chain must react and achieve the suitable structure for increasing the competitiveness level through the investments in product and process innovation – added Barile – Concerning this, according to a recent survey, 46% of Italian companies have started projects connected with Industry 4.0 and 29% of them undertook all that already two years ago».

Since 2007 until now, the world demand for vehicles, risen by over 30%, has enormously changed: industrialized and “motorized” Countries, historically production areas, have witnessed the decrease of the weight of their markets from 57% to 44%, whereas BRIC (Brazil, Russia, India and China), whose demand has grown by 118% versus 2007, have reached 37% of word sales (it was 23%). In the first 2017 semester, the global demand for vehicles reached 47 million units (+2.6%). In Europe, sales rise by 4.1% also thanks to Russia, which scores +7% after years of consecutive drops. In the same year, in Italy registrations grow by 9%, whereas the year-end forecasts expect 1.98 million registrations approximately (+8%).

Since 2007 until now, the world demand for vehicles, risen by over 30%, has enormously changed: industrialized and “motorized” Countries, historically production areas, have witnessed the decrease of the weight of their markets from 57% to 44%, whereas BRIC (Brazil, Russia, India and China), whose demand has grown by 118% versus 2007, have reached 37% of word sales (it was 23%). In the first 2017 semester, the global demand for vehicles reached 47 million units (+2.6%). In Europe, sales rise by 4.1% also thanks to Russia, which scores +7% after years of consecutive drops. In the same year, in Italy registrations grow by 9%, whereas the year-end forecasts expect 1.98 million registrations approximately (+8%).

The world vehicle production, supported by the positive demand trend, in 2016 scored over 95 million units, with +4.7% versus 2015. The world productive increment was by over 4.2 million vehicles, of which 3.5 produced in China.

In Italy, both the internal demand and the export have led to over 1.1 million units produced in 2016 (+9%). Compared to 2007, the world production registers, as for registrations, the 30% rise. In the first 2017 semester, according to the estimates by Ward’s Automotive Reports, the production scores the +2.4% growth and for Italy by 4.4%. In 2017, the world production of vehicles is expected to confirm the trend, exceeding 2016 volumes. In Italy the growth is going on, too, having closed the 1st semester 2017 at +7.3 (ISTAT data). In 2016, 54% of vehicles were manufactured in Asia-Oceania, 23% in Europe and 19% in Nafta area, 4% in the rest of the world.

China is the first producer nation in the world, with 30% of the world production, followed by USA (13%) and Japan (10%).

The chain structure

The automotive component world is constantly evolving: to take the chain complexity into account, intercepting all the categories of suppliers involved, the investigation has included in its observation range also activities like specialists in telematics and infomobility, motorsport and aftermarket.

According to this logic, among automotive component enterprises, we can distinguish: system integrators and module suppliers, at the top of the supply chain with factories located closed to manufacturer’s plants, which implement functional systems or modules, with a high competence level; specialists, producers of parts and components, with such a content of innovation and specificity as to constitute a competitive edge, encompassing also the category of telematics specialists that work at applications connected with infomobility; motorsport specialists that, starting from the fitting out of cars for sports competitions, design and manufacture components (seats, steering wheels and safety belts) or supply solutions adopted for mass productions, too; aftermarket specialists, which implement parts and components directly sold on the market through a distribution network or consortia of spare part suppliers.

According to this logic, among automotive component enterprises, we can distinguish: system integrators and module suppliers, at the top of the supply chain with factories located closed to manufacturer’s plants, which implement functional systems or modules, with a high competence level; specialists, producers of parts and components, with such a content of innovation and specificity as to constitute a competitive edge, encompassing also the category of telematics specialists that work at applications connected with infomobility; motorsport specialists that, starting from the fitting out of cars for sports competitions, design and manufacture components (seats, steering wheels and safety belts) or supply solutions adopted for mass productions, too; aftermarket specialists, which implement parts and components directly sold on the market through a distribution network or consortia of spare part suppliers.

They can have supply relationships with automotive industries but there are also aftermarket divisions of the same multinationals. Besides subcontractors, which produce standard parts and components according to the specifications supplied by customers and easily repeated by competitors, and in whose category we can identify the companies that execute mechanical machining such as turning, milling, rolling, stamping or treatments (thermal, painting etc.), the chain is completed by engineering and design activities, protagonists in the devising and design of a car, particularly numerous in Piedmont (55% of the Italian total), which supply services directly to assembling companies or Tier 1 suppliers.

The Observatory’s results

The survey, presented by Barbara Barazza, Manager of the Study, Statistics and Price Sector of Turin Trade Chamber, has highlighted that in 2016 all component manufacturers scored good performances: among suppliers, the most dynamic are the specialists in motorsport (+9.5% at Italian level), subcontractors (machining) (+9.4%), E&D (+7.8%) and system/ module providers (+5.6%).

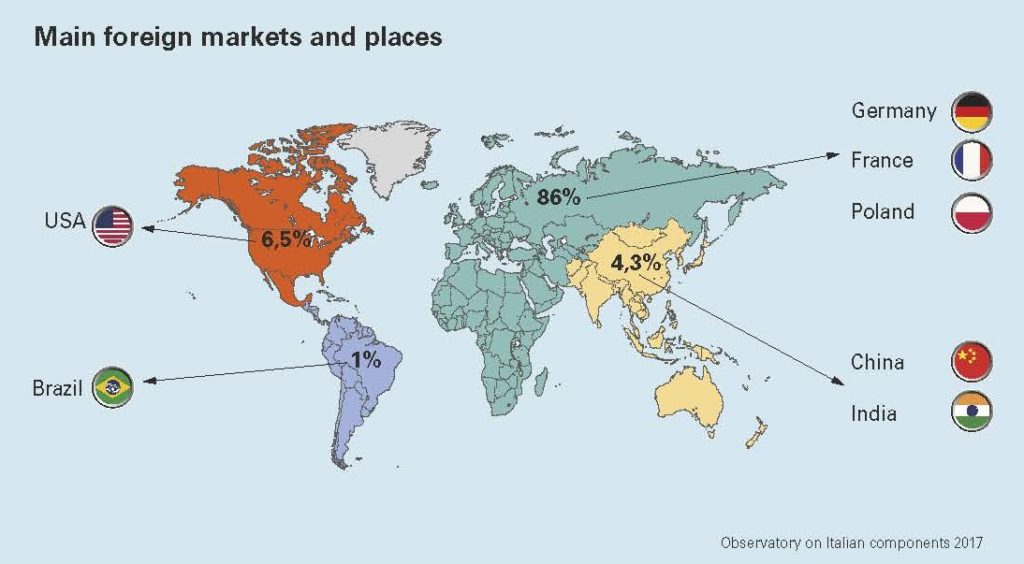

In Italy, over 76% of enterprises declare they export: the percentage has grown by one point in the last year (it was 75%). On the whole, 39% of the overall automotive turnover derives from export. EMEA (Europe, Middle East and Africa) is the main addressee of the Italian export, mentioned by 86% of enterprises but the first 5 markets are all in Europe (Germany, France, Poland, Spain and United Kingdom).

A sound component industry, thanks to export, geographical and productive diversification and enlargement of destination markets, succeeds in maintaining a high saturation level of the productive capacity, which in 2016 reached the 78% average. The percentage of enterprises that have declared a plant saturation percentage exceeding 80% has grown from 51% in 2015 to over 61% in 2016 and has indistinctively concerned all productive segments of the chain.

Sector players look optimistically at the future: for the current year, expectations not only maintain a positive sign but consolidate in comparison with the previous year: 87% of operators declare their optimism (80% in 2015) and confidence pervades all clusters, with particularly rosy forecasts for module and system providers (91% with growth estimates), specialists and E&D (89%) and the aftermarket (80%). Green, new materials, infomobility, autonomous drive, electric and hybrid motors represent the new directions in the process of transformation of automotive induced activities, like the cost reduction and the process reorganization. Finally, 71% of the sample declare they invest part of their turnover in research and development activities that are prevailingly carried out “in house”.

The round table

The last part of the press conference on the Observatory was dedicated to a discussion, chaired by Francesco Zirpoli, Center for Automotive and Mobility Innovation, Ca’ Foscari University, on the opportunities and the challenges for the Italian component chain.

«The Italian automotive supply chain is living a time of growth and development. However, the mobility world is changing. The Italian component industry will be able to constitute the backbone on which to base the mobility future in Italy if it succeeds in reversing the trend involving lower investments than international competitors in research and development and scarce networking to gain access to new technological competences.

As far as the overall Italian situation is concerned, the challenge to be won is maintaining in Italy the design and the production of vehicles, systems and modules with high technological complexity. This requires a trend inversion in innovation investments that currently position Italy in a disadvantaged situation compared to Countries with a similar industrial tradition». Massimo Mucchetti, President of Senate Industry, Trade and Tourism Commission highlighted that in Italy, in industrial ambit, components are becoming more and more important than the implementation of the finished product but it is necessary to invest to be in the technological forefront.

As far as the overall Italian situation is concerned, the challenge to be won is maintaining in Italy the design and the production of vehicles, systems and modules with high technological complexity. This requires a trend inversion in innovation investments that currently position Italy in a disadvantaged situation compared to Countries with a similar industrial tradition». Massimo Mucchetti, President of Senate Industry, Trade and Tourism Commission highlighted that in Italy, in industrial ambit, components are becoming more and more important than the implementation of the finished product but it is necessary to invest to be in the technological forefront.

Giorgio Elefante, Automotive Sector Leader Italy Price Waterhouse Coopers was then called upon to speak: «There are some key points for the business management: the awareness of challenges, the conscious determination of strategies, the individual and collective professional force and institutions’ support. We need clear rules supporting innovation. The automotive sector is driven by some big changes that will exert an impact on mobility, such as demographic trends and urbanization, the geo-political scenario characterized by a rising climate of protectionism, climatic changes and the shortage of resources, the technological evolution of products and services. Finally, internationalization plays a determinant role and it is necessary to support those enterprises that invest in research and development centres so that they can create sustainable value».

Vincenzo Ilotte, General Manager 2A Spa highlighted the great flexibility of the net in our entrepreneurial fabric and how this element can represent a point of attraction. In the opinion of Giuseppe Barile it is necessary to focus on research and development. Ezio Fossati, ZF Senior Vice President FCA & CNH Global Sales Division A has reconfirmed that it is essential to create an eco-system of collaborations: «Technologies evolve so quickly that no company can have all competences in its inside» (Elena Ferrero).

More than 1.6 million vehicles are likely to be sold

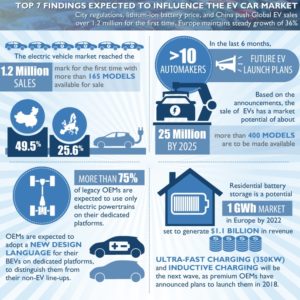

According to Frost & Sullivan’s recently released “Global Electric Vehicle Market Outlook, 2018”, the electric vehicle market reached the 1.2-million sales mark for the first time, with more than 165 models available for sale. China is leading the market with 48% market share followed by Europe with 26%.

Solid-state batteries

Solid-state batteries are likely to be the “game changers” of future battery chemistries, as they render 2.5 times higher density than lithium-ion. In the last 6 months, more than 10 automakers have announced future electric vehicle launch plans. Based on the announcements, electric vehicle now have a market potential of about 25 million units that will be sold by 2025; more than 400 models will be made available.

The Tesla Gigafactory is currently 35% operational and aims to produce 50 GWh of batteries in 2018. On full capacity, it will manufacture 150 GWh which will power an equivalent of 1.5 million vehicles with a 100 kWh battery capacity. Toyota, Fisker and BMW are likely to be the first automakers to adopt the battery in its electric vehicles by 2023.

Charging infrastructures

The electric vehicle charging infrastructure challenge has not yet been addressed, as there is a need for more charging stations globally.

Currently, the density of charging stations is high in limited areas or regions where an electric vehicle sale is highest.

Costs and market

Electric vehicles are likely to cost the same as conventional cars by 2020 which will be a huge threat to the conventional car industry. The EV industry will no longer require financial support from the government to regularise the price of an Electric vehicle in the form of cash incentives.

Logistics companies, such as DHL, DPD, TNT, etc., are switching to a 100% electric fleet by replacing current conventional vehicles with electric vehicles that are equally competent and a perfect fit for the business model. OEMs are shifting to 100% electric vans by 2020. 11 OEMs have announced electric vehicle milestones and targets.

If all the announcements made so far were to come true, there will be about 25 million electric vehicles sold by 2025 or 20% of all cars sold would be EVs.

Energy and petrochemical companies have started investing heavily in establishing electric vehicle charging stations, as they are likely to be the biggest beneficiaries of the electric vehicle market. Shell acquired the largest infrastructure operator “The New Motion” in the Netherlands which owns a network of 30,000 charging stations.

Manufacturing technology for electro mobility

At the end of January 2017, GROB acquired 100 percent shares in DMG meccanica, substantially reinforcing the competences and developments in electro mobility, which it has been developing for several years. The technologies of DMG meccanica and the new processes developed by GROB will now enable GROB to provide all the vital manufacturing processes and procedures in electric drives for the automotive industry and its suppliers worldwide, and also to supply them for series production in the near future. DMG meccanica has many years of specialization and experience in machinery and plant manufacture for the production of stators for electric motors, alternators andgenerators. The technological know-how is based on the tried-and-tested winding process of inserting technology and needle winding.

Most of the machinery and plant of DMG meccanica is used directly in the automotive industry. GROB develops and tests new processes, developed specially for the series production of stators for electric motors in electric vehicles, in its own development department. The future cooperation is therefore a win-win situation for both companies. GROB has secured further know-how in the field of electro mobility and DMG meccanica has found in GROB a strong, globally- oriented partner for series production. Further investments to expand these technologies in the field of electro mobility are planned at both sites in Turin and Mindelheim.

Mauro Marzolla and the father of Marco Debilio founded DMG meccanica in 1992 from a spin-off of one of the leading Italian providers of winding machines for electric motors. In 2016, their company with a workforce of forty employees achieved a total turnover of ten million Euro. Their customer portfolio includes many well-known electric motor manufacturers and suppliers to the automotive industry. DMG meccanica is particularly well-represented in the important e-mobility market of China. Owners Mauro Marzolla and Marco Debilio will stay with the company in future and will continue to be co-CEO´s of DMG meccanica. In addition, DMG meccanica will remain an independent company within the GROB-Group, and all jobs in Italy will of course be retained.

A leading machine tool manufacturer

GROB-WERKE is an internationally active family company based in the Bavarian-Swabian town of Mindelheim, with a product portfolio ranging from universal machining centers to highly complex manufacturing systems including automation, and from machining assembly units to fully-automated assembly lines. GROB is one of the few machine tool manufacturers that produces and supplies both machining and assembly equipment. Since the production of electric motors demands special assembly know-how, it was logical for GROB to seek a competent partner from the field of electric motor technology. Its takeover of DMG meccanica enables GROB to emphasize more than ever its claim in drive technology to be a leading and reliable partner for the automotive industry.

Growth performance of Italian automotive components industry

The market of automotive components is living a thriving time in Italy. As confirmed by 2016-turnover of about 39 billion Euros and export data accounting for almost 20 billion Euros.

Figures that let us be confident, not only for the current year but for the incoming ones as well, laying the bases for starting innovative projects in the automotive industry and the approach to more and more strategic foreign markets.

Automotive components in Italy: positive production and new markets

It is interesting to notice that today 75% of a vehicle is constituted by parts and components: a percentage that underlines the fundamental role played by the manufacturing chain of enterprises making up the sector of automotive components.

A field that, in Italy, stands out for dynamism and growth performance, besides a significant penetration into new Countries.

«The Italian componentry is a field that in Italy counts about 2,000 companies and 136,000 employees, with a yearly turnover of about 39 billion Euros. In 2016, the export value rose to 19.97 billion Euros, with a positive trade balance by 5.5 billion Euros», stated Giuseppe Barile, President of ANFIA–Components Group, during the convention “International scenarios in the automotive sector”, organized in Turin, to ponder possible scenarios and the future economic opportunities in the Italian and foreign Automotive industry.

A positive business trend that, according to ANFIA, is likely to be confirmed also in the current year, considering the car market trends in Italy, for 2017 and 2018, are neatly positive and also the production of vehicles in our Country is expected to score a moderate growth.

In the first 2017 quarter, the data presented by ANFIA confirm Italian component manufacturers’ capability of keeping their export volumes high, granting high quality and high innovation level of products and processes to the market, supported by a favourable ranking on international markets, too.

Vehicle export, % out of total export by destination Country, Jan 2017 (Source: Istat Foreign Trade).

Among the most interesting Countries, as highlighted during the Turin convention, new areas stand out, like North Africa and Iran, which in the last years have succeeded in offering new interesting development opportunities to the Italian enterprises operating in this sector.

«The manufacturing chain of Italian automotive components must seize these new possibilities studying suitable penetration strategies for the peculiarities of these markets» explains Giuseppe Barile. «The prospects we are facing, despite the political turmoil triggered by Brexit and by the election of the USA President Donald Trump, are not destabilizing.

Europe features a globally positive situation, with moderate growth expectations, in search of a new stability. If we consider the enterprises of our production chain, it is likely that big multinationals will be called to an adaptation to local realities, and then to a higher flexibility, which means to suit better contexts, legislative and tax rules and, in general, the requirements of the single nations were their subsidiaries operate.

Meanwhile we foresee significant opportunities for SME, which will rely on their proximity to the market and exploit at best the new technologies in manufacturing processes – Industry 4.0 and digitalization – in favour of the highest flexibility and customization of products».

A rising export for automotive components

The export of automotive components represents 4.8% of the entire Italian export (a value in line with 2015-year’s), whereas imports are worth 3.9% approximately. «In 2016, the export of components remains positive, confirming the good sector trend in foreign markets» commented Giuseppe Barile, President of ANFIA-Components Group.

«As already in 2015, exports, combined with the domestic demand, backed the national manufacturing. This occurred for both the vehicle field (with a production growing by 8.8% in 2016 and sales abroad rising by 6.3%) and for automotive components, with the 0.7% production upswing in the year just ended».

According to ANFIA, the orders, for the component production sector, grew by 4.4% in 2016 (by 5.7% for domestic automotive components and by 2.8% for foreign ones).

The first destination market of the Italian automation component export remains Germany, with around 3.9 billion Euros (-1% compared to 2015) and the 19.5% percentage (19.7% in 2015) on the total exported, while, for the second consecutive year.

Japan confirms to be first among Asian destination Countries (and fourth non-EU market, after Turkey, USA and Brazil), with over 395 million Euros (+31.3% versus 2015), with a positive trade balance amounting to 174 million Euros (they were 82.4 million in 2015), surpassing China (346 million Euros, with the 16% upswing compared to 2015 and a negative trade balance of 690 millions).

Decreasing by 23% are instead the exports towards the NAFTA Area, by a value of 1.5 billion Euros, maintaining a positive balance of over 605 million (892 million in 2015).

The export value drops by 28% towards USA and by 13% towards Canada, whereas in the last part of the year it recovers towards Mexico (+0.9%).

Country that in 2016 attained a new manufacturing record, with over 3.6 million vehicles (+0.9%) and now living a diversification phase of investments and of decreasing dependence on United States, after the protectionist measures adopted by the new American Government.

Exports: mechanical components are driving

The subdivision of automotive components into macro-classes witnesses the mechanical part ambit (including accessories and glasses) achieves 65.4% of the export value, with 13.06 billion Euros (-0.2% compared to 2015) and a positive trade balance of around 5 billion (5.5 in 2015).

With a value of 3.86 billion Euros (-0.3%), the motor field follows, weighing by 19.3% on the total exports of automotive components, with a positive balance of 1.13 billion Euros. The field of tires and rubber items for vehicles features an export value of 1.19 billion Euros (-1.8% versus 2015), with a negative balance of 482 million Euros. The exports of the sound reproducer field score instead the 14% increment.

The export of electric components and similar achieves the 6.3% growth, with a positive balance of 71 million Euros (75 million in 2015). Concerning single components, a significant positive trade balance is reached by motors (1.13 billion Euros), brakes (945 million Euros), bridges with differential (674 millions), pumps (374 millions), glasses (325 millions), wheels (303 millions), headlights and lamps (222 millions).

Growing production for the Italian automotive in 2017

According to the preliminary data released by ANFIA, in February 2017, the domestic production of cars registered the 6% rise, with almost 65,000 manufactured units.

Export and domestic market went on driving production data: in the first 2017 quarter, the automotive market achieved growing volumes by 12%.

In particular, in January 2017, the vehicle exports from Italy reached a value of 1.74 billion Euros (+27.7%), representing 5.5% of all exports, whereas the vehicle imports account for 2.48 billion Euros (+27.9%), i.e. 7.7% of all Italian imports.

United States represent in value the first destination Country for the export of vehicles from Italy, with the 19.3% percentage, followed by Germany and France, with shares by 12.3% and 10.9% respectively.

In this context, also the Italian production of automotive components and accessories for vehicles and their motors ends the month of February with a positive trend (+9.9%) and the first two months with +4.5%. In January 2017, according to the last available data, the orders of this specific field grew by 12.6% (+13.6% domestic orders and +11.6% foreign orders).

The turnover achieved by components is therefore growing by 10.2% in January, especially thanks to domestic components, with the 12.1% upswing.

Towards a smarter and eco-friendly car

How will the car of the future be? What technological, structural and manufacturing demand will it satisfy?

«The current technological trends move towards a double direction: an increasingly sustainable, but also safer and smarter, mobility» explained the President of ANFIA-Components Group at the Turin convention.

Within 2021, the European Automotive industry will reduce CO2 emissions by almost 42% compared to 2005, so becoming one of the most virtuous industrial sectors.

«This means that the Automotive manufacturing will go on investing in the optimization of vehicle technologies, aiming at a further improvement of the internal combustion motor efficiency and at the weight reduction, through the use of new materials and nanotechnologies as well as a greater diffusion and an enhancement of the performances of vehicles with alternative power supply».

This scenario influences a more and more incisive development of alternative and hybrid technologies in automotive ambit, even if Italy seems to proceed more cautiously in comparison with the other European Countries.

According to an analysis by ANFIA, during 2016 Italy holds the eleventh position by registrations of electric cars (in the ranking of European Union nations extended to EFTA).

That record includes pure electric, hybrid plug-in and hybrid extended range and has just 2,827 registrations out of a total of 206,600, even if growing by 20.7% versus the previous year.

Their market share in Italy is 0.2%. Hybrid cars (encompassing petrol-electric and diesel-electric) registered in 2016 are 37,000, rising by 47.2% compared to 2015, corresponding to 12% of the European market. Their market share in Italy is 2%.

If we analyse the car registrations in the first 2017 quarter and we subdivide them by power supply, in March the market share of petrol cars remains stable with 33.5%. Whereas for diesel cars the percentage grows from 55.8% in February to 56.2%.

The market of hybrid and electric cars features rising volumes that exceed the average, both in the month and in the progressive since the year beginning.

The market share, even if inferior to February one (3%) reaches 2.6% in March, versus 1.8% of one year ago. LPG cars show an exceptional growth as well, both in March and in the first quarter, rising their market share to 6.1% in the month (6.3% in February), against 5.4% of one year ago.

Natural gas cars are instead still dropping; the penetration percentage, even if rising in March 2017 (1.6%) in comparison with the previous month (1.4%), is lower than one year ago (2.5%). «The purchase price of hybrid and electric cars, considering in particular electric models, is still too high for a mass diffusion, if it is not supported by adequate incentive policies» states Giuseppe Barile.

«On the other hand, the electric car industry sets the target of reaching production levels finally allowing significant scale economies and then a decrease of car purchasing prices.

Thus widening the range of buyers. In general, future prospects indicate a mix of alternative power supplies, according to a technology-neutral approach, in conformity with the limits of emissions and environmental targets established at European level». Moreover: «It is worth reminding that the development of infrastructures for alternative fuels is a key element for the enhancement of the relative market of vehicles with alternative power supply. It is progressing, in our Country, thanks to the implementation of the European Directive DAFI. This outlines for the first time a shared framework of measures aimed at the implementation of infrastructures for alternative fuels to be carried out through national strategic frameworks.

Thats includes the minimal requisites for the construction of recharge points for electric vehicles and natural gas refuelling points (LNG and CNG), LPG, biomethane and hydrogen.

The Legislative Decree 16th December 2016, n. 257, in force since 14/1/2017, governs the implementation of the Directive in Italy and is fruit of a synergistic work among ANFIA and the other concerned associations».