As it develops its plans for the mobility of the future, the BMW Group is increasingly focusing on co-operations to help make next-level electrification technology more widely available to customers by the start of the coming decade.

The BMW Group and Jaguar Land Rover confirmed they are joining forces to develop next generation electric drive units in a move that supports the advancement of electrification technologies necessary to transition to an ACES future.

The BMW Group brings long experience of developing and producing several generations of electric drive units in-house since it launched the pioneering BMW i3 in 2013. Jaguar Land Rover has demonstrated its capability with this technology through the launch of the Jaguar I-Pace and its plug-in hybrid models.

The BMW Group’s most sophisticated electrified technology to date features an electric motor, transmission and power electronics in one housing. This electric motor does not require rare earths, enabling the BMW Group to reduce its dependence on their availability as it continues to systematically broaden its range of electrified models.

Starting next year, the BMW Group will introduce this electric drive unit, the fifth generation (“Gen 5”) of its eDrive technology, with the BMW iX3 Sports Activity Vehicle. The Gen 5 electric drive unit will be the propulsion system upon which subsequent evolutions launched together with Jaguar Land Rover will be based.

“The automotive industry is undergoing a steep transformation. We see collaboration as a key for success, also in the field of electrification. With Jaguar Land Rover, we found a partner whose requirements for the future generation of electric drive units significantly match ours. Together, we have the opportunity to cater more effectively for customer needs by shortening development time and bringing vehicles and state-of-the-art technologies more rapidly to market,” said Klaus Fröhlich, Member of the Board of Management of BMW AG, Development.

Cooperation between BMW and Jaguar Land Rover

A global electric motor market overview

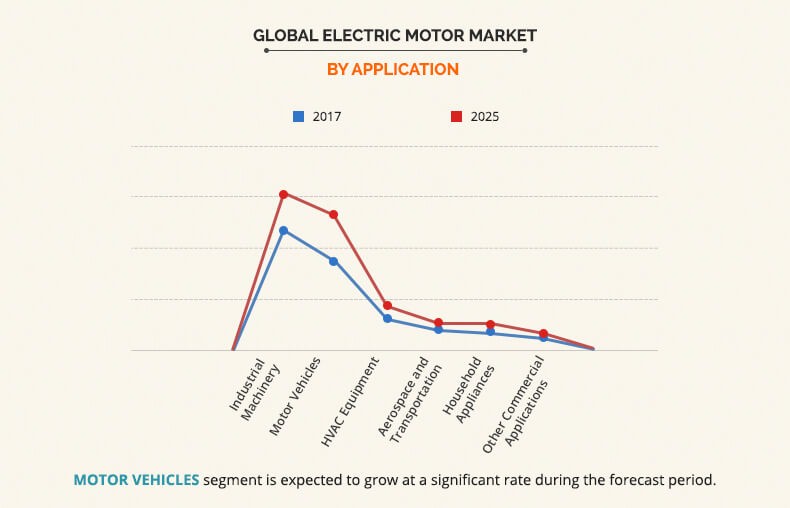

The “Global electric motor market” report, a recent research by Allied Market Research, has revealed that the global electric motor market size was $96,967.9 million in 2017, and is projected to reach $136,496.1 million in 2025, growing at a CAGR of 4.5%.

The rise in demand for superior machine control in automotive industry, owing to the high efficiency of AC synchronous motors fuels the electric motor market growth.

The regulations such as Minimum Energy Performance Standards (MEPS), drives the growth of energy efficient electric motors market across the world.

The material handling systems serve as the key consumers of fractional horsepower (FHP) motors, thus boosting their demand across the globe. Moreover, the adoption of motors ranging 21-60 V in HVAC sectors, owing to the heat dissipation, are anticipated to exhibit high demand for these motors in the coming years.

However, the industrial motors with high power rating generate substantial vibration, strain, and heating during their performance, which could potentially have profound influence over electronic components, and result in their malfunction. In addition, lack of awareness of benefits associated with smart motors among small and medium enterprise owners for various applications is expected to hinder the growth of the electric motor market during the forecast period.

However, the industrial motors with high power rating generate substantial vibration, strain, and heating during their performance, which could potentially have profound influence over electronic components, and result in their malfunction. In addition, lack of awareness of benefits associated with smart motors among small and medium enterprise owners for various applications is expected to hinder the growth of the electric motor market during the forecast period.

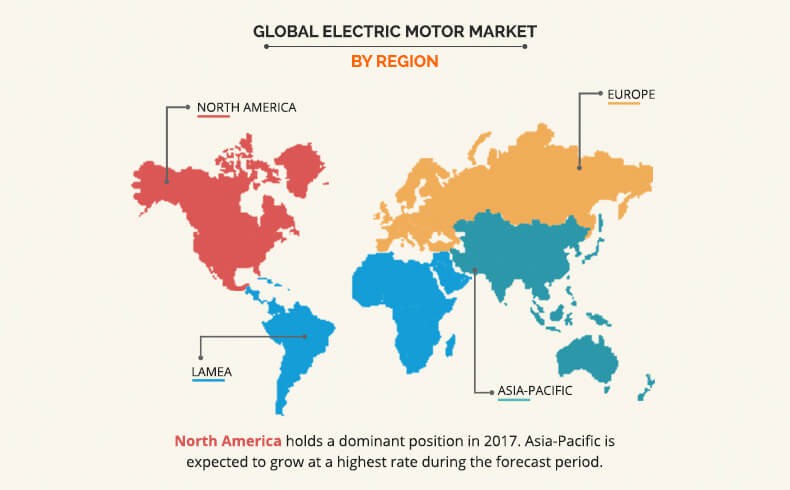

The global electric motors have widespread demand in North America, followed by Asia-Pacific, and Europe. The highest share of the North America market is attributed to the increase in demand in AC motors in automotive sectors.

The global electric motor market is also witnessing considerable growth in the emerging markets such as India, China, and others. This growth is attributable to the development of the automotive, machinery, and fan & ventilation industries and high demand for better energy-efficient electric pumps.

Increase in demand for medium to large voltage motors, particularly in emerging wind power markets, is further expected to fuel the market growth. However, rise in use of other energy-efficient motors as an alternative to conventional motors is anticipated to hinder the market growth. North America is witnessing the highest demand for AC synchronous motors, followed by Asia-Pacific, Europe, and LAMEA. The highest share of the North America market is attributable to increase in demand for conveyers in the industrial machinery segment.

THE REPORT

The “Global electric motor market” report by Allied Market Research, provides an extensive analysis of the current and emerging market trends and dynamics in the global electric motor market.

In-depth electric motor market analysis is conducted by constructing market estimations for the key market segments between 2017 and 2025 and by following key product positioning and monitoring of the top competitors within the market framework.

A comprehensive analysis of all regions is provided to determine the prevailing opportunities.

The global electric motor market forecast analysis from 2018 to 2025 is included in the report.

The global electric motor market is segmented into motor type, output power, voltage range, application, speed, and region.Based on motor type, the global market is divided into AC, DC, and hermetic motors. AC motors has two subsegments, which includes synchronous AC motors, and induction AC motor. Similarly, DC motor is further classified as brushed DC motor and brushless DC motor. In 2017, the AC motor segment held the largest share, due to increase in demand for energy-efficient conveyor systems in manufacturing and automotive industries. Based on output power, it is classified into integral horsepower (IHP) output, and fractional horsepower (FHP) output. By voltage range, the market is categorized into 9 V & below, 10-20 V, 21-60 V, and 60 V & above. In 2017, the 60 V & above motor segments held the largest share, due to its increase in demand in heavy industrial machinery industry for energy-efficient conveyor systems in manufacturing and automotive industries.

Based on output power, it is classified into integral horsepower (IHP) output, and fractional horsepower (FHP) output. By voltage range, the market is categorized into 9 V & below, 10-20 V, 21-60 V, and 60 V & above. In 2017, the 60 V & above motor segments held the largest share, due to its increase in demand in heavy industrial machinery industry for energy-efficient conveyor systems in manufacturing and automotive industries.

Based on application, the global electric motor market is classified into industrial machinery, motor vehicles, heating, ventilating, and cooling equipment (HVAC), aerospace & transportation, household appliances, and other commercial applications. In 2017, the industrial machinery segment held the largest share, due to increase in demand for compressors systems in manufacturing and automotive industries. Based on speed (rpm), it is classified into low-speed electric motors (less than 1,000 rpm), medium-speed electric motors (1,001-25,000 rpm), high-speed electric motors (25,001-75,000 rpm), and ultrahigh-speed electric motors (greater than 75,001 RPM).Region wise, the electric motor market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2017, North America accounted for the highest share, and is anticipated to secure the leading position during the forecast period. This is attributed to industrial growth and expansion of aerospace industry. U.S. is a pioneer in the electric motor market. Therefore, the electric motor market share is highest among the North American countries.

Get more information on this report>>>

E-mobility and professionals, here is the research

The report “The e-mobility seen by professionals” was drawn up after a research in collaboration with Audi, on the base on an interview with an audience of 2450 professionals about their business travel habits and how they perceive electric mobility. In the opinion of the interviewed professionals, the car of the future is battery-powered and will allow improving the home-office displacement (56%) and e-cars “would provide real consumption/cost advantages, to the extent that 48% are willing to buy one. A choice certainly made not superficially if we think that one third (30%) of interviewees state they travel from 5 to 15 km a day to go to work and that in one case out of two (48%) the chosen vehicle is precisely four-wheeled.

Therefore, how do tomorrow’s workers imagine mobility? For professionals, a vast majority of them self-employed workers (52%), the e-mobility horizon is getting closer, even if gradually: over 53% estimate that it will take 15 to 20 years to have at least half of the circulating cars rechargeable.

The first Chinese factory fully dedicated to the e-mobility is starting

Purposely built for the production of fully electric vehicles based on the MEB modular platform, the new factory of the joint venture Saic Volkswagen and Antig is completed and the pre-production has started. The line has in fact produced a purely electric Volkswagen ID model, specific for China, and the mass production start is scheduled by October 2020.

MEB is a unique platform specifically ideated for the production of high volumes of electric vehicles, which allows a longer pitch and more spacious interiors. Besides, the models produced on this base will be equipped with state-of-the-art infotainment systems and connectivity functions seamlessly integrated into daily life.

«Volkswagen Group provides for a total volume of 22 million purely electric vehicles on a global scale within 2028, of which over 50% coming from China. The Country – stated Herbert Diess, President of the Board of Directors of Volkswagen Group – plays a fundamental role in our electrification strategy, which will help the Group to reach the target of becoming neutral in terms of CO2 within 2050. With the production start on MEB base, we will introduce also in China the Volkswagen ID family, a brand-new generation of purely electric and connected vehicles».

Smart and digitalized, Anting plant becomes a new example of smart sustainable factory for Volkswagen Group China and for the entire Chinese automotive industry.

Joint Venture at the conquest of China

ZF and Wolong Electric companies are protagonists of an important partnership in the world market of the electro-mobility that will produce components and electric motors for automotive applications. This joint venture will operate under the name Wolong ZF Automotive E-Motors Co Ltd, will develop the product portfolio by ZF and will further improve the competitiveness in electric transmission systems.

A first success of this partnership is the assignment of an important contract for the mass-production of components for the electric motor for hybrid and electric transmissions, which significantly share in reducing CO2 emissions from the road traffic. ZF informs that this move with a Chinese company represents a fundamental step forward in the implementation of its commitment to investing in China.

Meanwhile, ZF is constantly developing its integrated systems for network and automated applications. In the spring of the current year, the Group has further strengthened its ranking in rising markets for MaaS solutions acquiring the majority shares of 2getthere, Dutch mobility supplier. For over 20 years, 2getthere has been offering autonomous-drive shuttles for a broad variety of applications, with the applicative spectrum of fully automated electric transport systems, which range from airports to industrial parks, thematic parks and urban transport infrastructures.

Since January 2016, ZF has grouped its activity in the electro-mobility field in the E-Mobility division headquartered at Schweinfurt, in Germany. Over 9,000 employees work in the division, spread in various sites worldwide.

Electric development in Italy, resources worth 136 milions

The Italian Minister for the Economic Development, Stefano Patuanelli, has given the green light to the decree for the Development Agreement among Mise, Basilicata and Piedmont regions, Invitalia and the companies Fiat Chrysler (Fca) Melfi, Fca Italy and CRF (Fiat Research Centre) for a programme of research, development and production of electric and hybrid vehicles in the factories in Melfi, Orbassano and Torino Mirafiori.

It is a plan worth 136 milions that will be financed within 2022. In particular, 98.7 million Euros will be used to increase the production in the Melfi factory of Jeep Compass in the hybrid plug-in version.

Other 37.9 million Euros are instead allocated for the project Recharge – Sustainable solutions with high modularity and configurability for mass-market vehicles with 100% electric propulsion, with the aim of developing pure electric vehicles at accessible prices, in Melfi, Orbassano and Torino Mirafiori plants.

This programme will have a positive employment impact that will allow the gradual reintegration of the staff in solidarity contract and the creation of further 100 workplaces at Melfi factory.

Smart Mobility Report: opportunities and challenges

More than yesterday, less than tomorrow. The market of electric vehicles has been put under the magnifying glass by the Smart Mobility Report 2019 that has outlined opportunities and rising challenges for the supply chain on an Italian and European scale.

It is becoming a reference point for the world of electric vehicles, an analysis that highlights the main macro-trends of a sector that is greatly evolving towards a smarter and smarter concept. The issue is the Smart Mobility Report 2019 by the Energy&Strategy Group of the School of Management of Milan Polytechnics, run by the Director Vittorio Chiesa, where are detailed the data concerning the electric car’s environmental impact, the diffusion of electric vehicles and recharge structures on an Italian, European and world scale and the potential developments of the market in Italy.

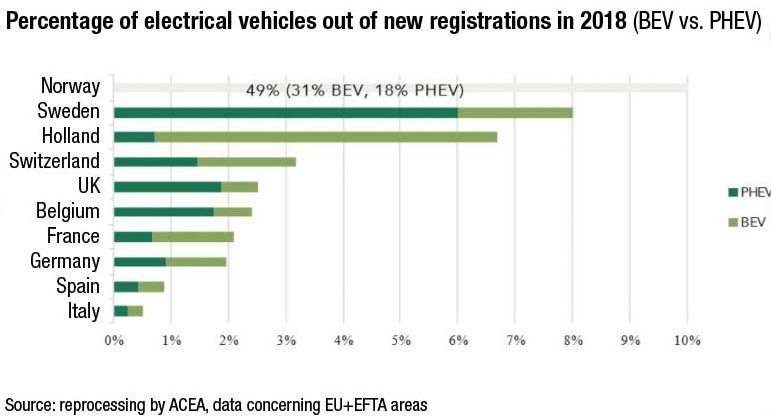

EV percentage out of overall registrations in each single Country

Before analysing the Report content thoroughly, it is advisable to specify what we precisely mean with “Smart Mobility”, concept driven by the three main macro-trends of electrification, autonomous drive and sharing mobility. «As Smart Mobility we indicate the evolution of the mobility world towards a more sustainable model in the various assets, therefore environmental – through the reduction of transports’ impact, social – with an improvement of the life quality, and also economic, in relation to a decrease of transports’ cost » – stated the Professor Vittorio Chiesa.

As Smart Mobility we indicate the evolution of the mobility world towards a more sustainable model in the various assets, therefore environmental – through the reduction of transports’ impact, social – with an improvement of the life quality, and also economic, in relation to a decrease of transports’ cost.

World overview

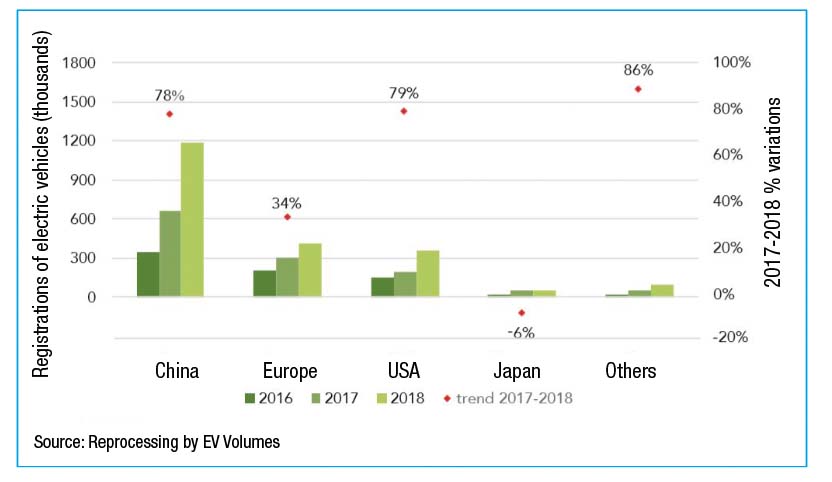

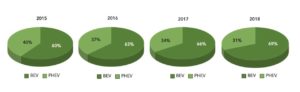

In 2018, about 2.1 million electric vehicles were registered in the world, including passenger cars and Light Duty Vehicle (both BEV and PHEV), a datum rising by 78% compared to the previous year, with a total stock that, on a global level, has reached 5.4 million vehicles. This constant growth results in the expectation of exceeding the threshold of 3 million electric vehicles registered in 2019 and in a stronger shift from PHEV, Plug-in Hybrid Electric Vehicles characterized by both electric and internal combustion propulsion, towards BEV, Battery Electric Vehicle, therefore vehicles without internal combustion engines but just equipped with an electric propeller that exploits the energy stored in the traction battery.

With about 1.2 million electric vehicles registered, China is the biggest world market, followed by the United States with over 400,000 registered units (34% more than in 2017) while Japan ranks third, with 53,000 vehicles.

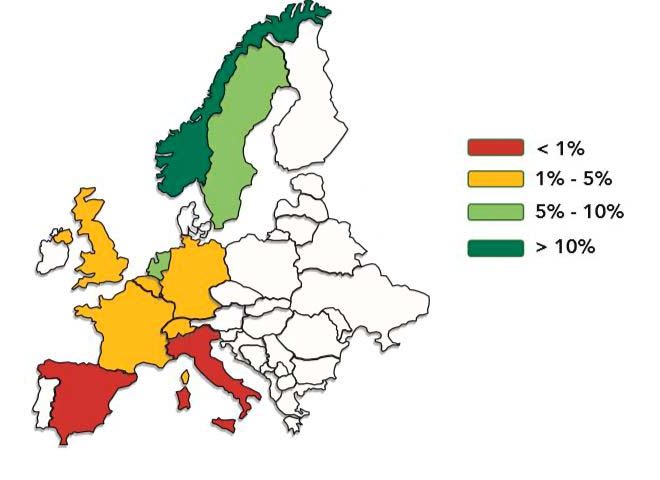

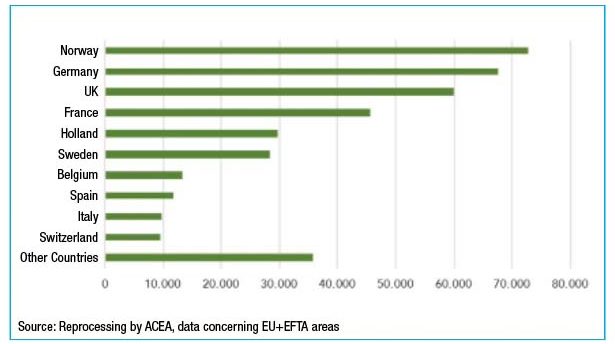

In 2018, in Europe the registration of electric cars grew by 33% versus 2017, with a number amounting to 384,000 units. The gold medal is won once more by the virtuous Norway, third Country on a world scale after China and United States, with over 72,000 electric cars registered, 49% out of the total of cars inside the nation. Germany confirms to be the second European market, with over 67,000 electric cars registered, followed by Great Britain and France, respectively with almost 60,000 and more than 45,000 electric cars.

Italy, still a little behind in the global ranking, in 2018 weighed by 2.5% of the European market of electric cars, versus 12% of total registrations.

The influence of incentives in Europe

If we analyse each Country of the Old Continent, the subdivision of electric cars’ registrations in 2018, both BEV and PHEV, results in a highly variegated mix that leads to 3 different “clusters”: BEV-oriented that includes Holland, France and Norway; PHEV-oriented, of which Sweden, United Kingdom and Belgium are part, and the group of Balanced that includes Switzerland, Germany, Spain and Italy. Such scenario has been influenced by incentive and tax schemes along the time.

The analysis highlighted by the Report shows the emissions of carbon dioxide along the life cycle of the vehicle are lower for electric vehicles than for vehicles with internal combustion engine. For both vehicle typologies, we identify as worst case the scenario in which the battery production and the vehicle assembly take place in China. The best case is instead associated to the 100% Italian manufacturing chain, where all components of the vehicle are produced and assembled in Italy, with a saving of emissions in the order of 30% for BEV and of 15% for ICEV. The impact of the use phase is higher for the vehicles with internal combustion engine: from 75% to 88% of the total of CO2 emissions in the lifecycle. Concerning BEV, instead, this share ranges from 40% to 65% and strongly influences the energy source with which the energy that supllies the electric vehicle is produced. The battery component has a very important weight in terms of emissions for electric vehicles: the emissions associated to its production constitute about 35- 55% of the total inherent to the vehicle implementation phases.

The analysis highlighted by the Report shows the emissions of carbon dioxide along the life cycle of the vehicle are lower for electric vehicles than for vehicles with internal combustion engine. For both vehicle typologies, we identify as worst case the scenario in which the battery production and the vehicle assembly take place in China. The best case is instead associated to the 100% Italian manufacturing chain, where all components of the vehicle are produced and assembled in Italy, with a saving of emissions in the order of 30% for BEV and of 15% for ICEV. The impact of the use phase is higher for the vehicles with internal combustion engine: from 75% to 88% of the total of CO2 emissions in the lifecycle. Concerning BEV, instead, this share ranges from 40% to 65% and strongly influences the energy source with which the energy that supllies the electric vehicle is produced. The battery component has a very important weight in terms of emissions for electric vehicles: the emissions associated to its production constitute about 35- 55% of the total inherent to the vehicle implementation phases. Germany, for instance, offers a direct incentive of 4,000 Euros and the road tax exemption for 10 years for the purchase of BEV cars and of over 3,000 Euros for PHEV; similar situation for Spain that provides for an incentive of 1,300 Euros for cars with purchase price under 32,000 Euros and of 5,500 for cars with autonomy exceeding 71 km. In France, the State allocate up to 6,000 Euros for the purchase of cars that release less than 20 grams of CO2/km and there is a disincentive to the purchase of diesel and petrol cars based on the “polluter pays” principle. Among the best practices, stands out the one of Norway, which has introduced incentives already since 1990, both direct and indirect, like the absence of tolls and the free access to parks, like in Holland.

Since October 2018, the United Kingdom has introduced incentives amounting to 35% of the purchase price, up to a maximum of 3,500 pounds, Belgium supports with imports that decrease hand in hand with the increase of the purchase cost while Sweden has an articulated system that reaches 5,600 Euros for BEV vehicles.

Recharge trends and evolution of infrastructures

The direction of the recharge infrastructure for electric cars is strictly connected with the main requirements, today not sufficiently satisfied. The need of decreasing recharge times is leading to an increment of the power supplied by columns and to a “Battery Swap” service, then the substitution of the low battery of a vehicle with a charged one, instead of recharging.

The need of an extremely user-friendly operation is leading to the development of Plug&Charge columns, of wireless recharges and of services like the emergency recharge. Finally, the demand for the integration of recharge systems in the urban context is resulting is different solutions such as the mobile recharge. In this context, it is worth underlining the big trend of the Vehicle Grid Integration, the direction that corresponds to the electric vehicle’s possibility of providing services in grid. The V2G declination, the so-called Veichle-to-Grid will be stronger and stronger, providing that the supply of grid services occurs through bi-directional flows of energy, therefore from the grid to the vehicle and vice versa. Nowadays, its diffusion is still quite limited and circumscribed to pilot projects; soon the revision of the regulatory framework is expected to make room for experimentations in this ambit.

Energy, direct or alternate?

The stronger and stronger orientation towards the direct current is one of the most debated topical issues, especially in the renewable energy world. Is a paradigm change really in course, recalling the original intuition by Thomas Edison?

Nowadays, topicality spotlights on energy provisioning are cast on the direct current and on the relative role in the ambit of renewable energies. This was precisely the theme of an event of cultural interest organized by Lapp.

“Ancient”, but very current matter, the direct current technique is conquering new supporters because the production, distribution and use modalities of electric current have deeply changed. This modification will lead to radical transformations at all levels of the industrial activity, connection technique included.

A bit of history: Thomas Edison & Co.

It is never out of place to review history a bit and in this case we must go back to over 140 years ago to return at the issue’s origins. At the end of 1882, the genius Thomas Edison, one of the greatest inventors in all times due to the authorship of as many as 1093 patents, inaugurated his first power plant that –moreover – electrified Wall Street in New York, and operated in direct current.

One of Edison’s collaborators at that age – nothing less than – Nikola Tesla, was entrusted with the development of a dynamo, but he had a brilliant idea: instead of working at the direct current, he focused on the alternate current technique.

Therefore, after “the separation” from Edison, Tesla carried out his project in collaboration with the “the competitor”, George Westinghouse and Edison did not absolutely change his mind. He did not want to recognize the advantages of the alternate current at all, like the simple current change through transformers for the transport on long distances and subtler cheaper cables. Well, the lighting of the world exhibition in Chicago in 1893 was generated by alternate current, constituting the first notable litmus test of the growing popularity of such technique. Only afterwards Edison admitted – but not publicly – that giving up alternate current was a mistake.

However, nowadays do we still think it was an error indeed?

2020 energy scenario: dispersion as enemy of efficiency

Edison’s concept and his “stubbornness” about the direct current is today redeeming itself through various present developments.

«An ambit in which the direct current is returning and arousing interest – explained Georg Stawowy, Member of the Board and CTO LAPP Holding AG – is the production of energy until now occurred in alternate current, for instance in generators of large nuclear or coal power plants or in hydraulic turbines. With this technique, the energy distribution is performed by transformers and a current reduction inside cables takes place, resulting in minor dispersion.

However, in the current scenario, more and more production systems that generate their energy under the form of direct current are entering the network. An example are photovoltaic plants, supported also by chemical batteries or accumulators that do not like the conversion from direct current into alternate current because it implies some losses». Therefore, in the light of the growing (and necessary) use of renewable energy production plants, today and in this context the best choice would be constituted by a direct current network. Efficiency, in fact, is undoubtedly the most convincing issue in favour of the shift to direct current. «If thermoelectric, nuclear and coal plants input alternate current into the network, and vacuum cleaners and lamps use it directly, the efficiency degree, at utility level, reaches about 65 %. This means that around one third of the electric energy is lost and today, more than ever, the situation is worsening owing to photovoltaic plants and solar energy power plants, besides the growing installation of battery accumulators that increase the current to be converted into alternate».

The same is true on utility side: as proven by the overheating of power supplies. The scenario shows the approximate 56% reduction of the overall energy network efficiency; a situation that needs a system reorganization.

Moreover, the CTO of LAPP mentioned us an alternative consisting in the use of the direct current technique for the transport on very long distances through transmission of high voltage direct current (HVDC), as well as of low voltage direct current networks in dwellings and in industry, to be connected to portable computers and industrial motors, for instance, without either feeders or inverters. With this solution and the mix made up by a photovoltaic plant on the roof and an electric car in the garage, an electric network set in direct current would allow reaching a very high overall efficiency: about 90 %.

Network, decentralized and star

Another reflection on this theme concerns the energy distribution; history shows us the electric network has been dominated for a long time by big power plants that distributed their energy to close regions according to a star configuration. The growing success of renewable energies has led to an increasingly decentralized and localized electric network, often with on-site exchange. «In these applications –Georg Stawowy explained in detail – the alternate current technique cannot provide its advantages. Nevertheless, the alternate current is not ideal on big distances, too, because the losses depending on transmission significantly increase. A HVDC connection, although twice more expensive in implementation phase, is advantageous in virtue of minor energy losses starting from a length of about 400 kilometres, while in case of submarine cables used for instance by offshore wind farms, it already offers advantages starting from 60-kilometre distances. Moreover, HVDC connections are extremely reliable. Due especially to the progresses made in the energy conversion through power electronics, direct currents can be converted up to 800,000 Volts, without using transformers».

The new energy use

In dwellings and in industrial factories, the current distribution occurs through low-voltage networks, then through Schuko sockets, or standard sockets for alternate current. The number of electric appliances that need direct current is steeply rising, including computers, LED lamps and also electric cars, dynamic market that makes us confident in the future. Besides, in the case of motors used in industry, the regulation of the revolution numbers is increasingly performed by frequency converters with intermediate circuit in direct current. «All conversion circuits from AC into DC of these converters would become superfluous if we chose direct current networks with centralized conversion into DC of the voltage. In the automotive industry, they are experimenting some pilot projects that provide for the exclusive power supply of entire manufacturing units with direct current and the use of batteries for energy accumulation in the short term».

For motors

«Instead of using a rectifier for each converter, we might power motors directly with direct current. Concerning this, ideal would be a direct current 380 V network, because intermediate circuit voltages are generally included between 350 and 400 Volts.

The possibility of choosing between direct current or alternate current operation would be easily implementable, too» here is the vision by Gaetano Grasso, who illustrated us the advantages of the direct current network in this context.

They consist in low losses caused by conversion, higher energy networks’ stability due to harmonics reduction, component saving and minor overall dimensions, more integration simplicity of decentralized renewable energy sources like photovoltaic and energy recovery, for instance use of brake energy and accumulation in batteries.

In the development of cables for direct current applications, LAPP plays a pioneering role, among the suppliers of products for the connection technology, which distributes electric cables, cable glands, connectors and accessories for a broad range of industrial applications, in Industry 4.0 ambit, too.

«In collaboration with one of the most important technical universities – explained Gaetano Grasso, Product Management & Marketing Manager of LAPP Italia – we noticed that in the ambit of some tests, in a direct voltage field insulating materials show a different ageing behaviour

compared to that shown in an alternate voltage field. Currently, we already offer a complete range for fixed and flexible applications in the direct current field and for industrial partners we have developed a hybrid cable that brings together all the functions for a motor control in a single insulating sheath».

Pilot project, Germania is master

In the last 2 years, complex applications have been implemented in various Countries and they have started pilot projects aimed at confirming the use of the direct current technique in the future. In the regions with inefficient net infrastructure, like India for instance, in the villages they are implementing a decentralized energy provisioning system based on direct current. In Germany, instead, in the industrial field, the direct

current technique holds nowadays a dominant position, especially in server fleets with high energy consumption. Here, use degree variations generate positive economic effects, whereas closed applications allow managing safety-related aspects with more efficacy. Moreover, in German territory they have started a joint project framed in a state programme of research promotion. Fifteen partners from various industrial sectors participate in the project, like LAPP, Daimler, Siemens and Bosch Rexroth, with various research institutes, thanks to which are stemming the first manufacturing plants with machines that will be equipped with a sturdy secure DC network. «Today, therefore –the manager of LAPP, Georg Stawowy, affirmed – we can then state the direct current has its reason for being in practice and is intended for gaining growing importance in the industrial application in Italy, like in all other industrialized Countries. Moreover, they are currently studying the ageing mechanisms of plastic materials permanently exposed to the direct current influence and intended for applications in both exercise systems like switches and electric boards and in lines. LAPP is currently very active in the ambit of a project that studies the long-term stability of insulating materials for cables and lines».

by Lara Morandotti

Electric cars: accelerating the spread?

A new study by mOve laboratory at the Politecnico di Milano has shown that there is an immediate opportunity to move a step forward even without waiting for the development of a public charging network.

The investigation has shown that there is an immediate opportunity to accelerate the spread of electric vehicles, even without waiting for the development of a public charging network.

The results

Around 13% of all private vehicle owners could purchase an electric car immediately, without changing their habits, with the most likely availability of a home charging point and breaking even on costs in comparison with a petrol-driven car in less than 8 years (with the current government incentives offered on their purchase and road tax).

The research is considered highly statistically reliable as it is entirely based upon real data: over 100 million trips in private vehicles, monitored over a period of 12 months, were analysed.

The researchers at the mOve laboratory obtained the results by cross-referencing an analysis of the distances covered, an in-depth economic assessment of the purchase of an electric car, and a geographical analysis of the location of the subjects’ homes to quantify the probability that they would actually have a home charging point available.

The analysis

According to the analysis of the distances, a sizeable 50% of private vehicles never make daily trips lasting longer than the battery life of the car (assumed to be around 300 km/190 miles in practice) over the course of the entire year, thus making it possible for them to make the switch to an electric vehicle without any changes in habits or usage limits, as long as they have a home charging point available, be it private or block-owned.

The study then went into greater detail with the analysis of this 50% of vehicles which are functionally ready to switch to electric, using an in-depth economic assessment (purchase costs, energy costs, road tax and insurance costs, depreciation, etc.) of an electric car compared to a petrol-driven equivalent.

One final study was carried out and cross-referenced with the others: a geographical analysis of the location of the subjects’ homes to quantify the probability that they would actually have a home charging point available.

By introducing this limitation, the percentage of total vehicles in the fleet that would be “immediately ready” to purchase an electric car was estimated to be 13%.

This opportunity could be further increased by encouraging car-sharing systems, making it easier to reach the economic “break-even” point for electric cars, and consequently reducing the need to introduce incentives.

Accomplished the conversion of the factory for electric mobility only

After 116 years, in Volkswagen plant in Zwickau, in Germany, they have produced the last car with combustion engine: a seventh-generation Golf R Variant. Since now onwards, in Zwickau they will manufacture only electric models of Volkswagen and, in the future, of Audi and SEAT brands, too. This choice implements for the first time the total shifting of a factory to the electric mobility.

In May 1990, Volkswagen started its production in this plant in Western Saxony and, in thirty years, they have manufactured 6,049,207 cars of Polo, Golf, Golf Variant, Passat sedan and Passat Variant models. After a conversion phase that will last some weeks, the first electric vehicles will be produced since the end of the current year.

The mass-production of the ID.3 1ST edition started in this factory in November 2019, while the manufacturing of the electric ID.4 SUV will follow in the course of Summer. ID.3 is the first model based on the MEB electric modular platform of Volkswagen, architecture purposely developed for battery cars, which optimally exploits the possibilities offered by electric mobility.

At full rate, the overall production capacity of Zwickau plant will reach 330,000 cars yearly.

The investments for the transition amount to about 1.2 billion Euros. In the final expansion stage, since 2021, here they will produce six models based on the MEB electric modular platform of three different brands of Volkswagen Group, becoming the biggest factory of electric cars in Europe.

Through a specific training, all 8,000 workers will be qualified to produce electric cars and to handle high-voltage systems. The team will complete around 20,500 total training days by the end of 2020 and all this will assure the certainty of workplaces in the long term in Zwickau.

(by Lara Morandotti)